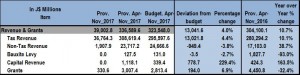

For the period of April 2017 to November 2017, the GOJ reported Total Revenues & Grants of $336.59 billion, $13.04 billion more than the government’s projection. Furthermore, year over year, this represents an increase of approximately 10.7% relative to the $304.10 billion recorded for the corresponding period in 2016. ‘Tax Revenue,’ ’Capital Revenue’ and ‘Grants’ outperformed projections while ‘Bauxite Levy’ and ‘Non-Tax Revenue’ under-performed projections during the review period. ‘Tax Revenues’ amounted to $308.62 billion, $13.02 billion more than budgeted, ‘Non-Tax Revenue’ of $23.72 billion was reported; $949.4 million less than budgeted. ‘Grants’ totalled $3.01 billion, $194 million or 6.9% more than budgeted. In addition, “Bauxite Levy” closed at $127.5 million, relative to the budgeted figure of $131.0 million, while ‘Capital Revenues’ outperformed projections by $778.7 million to total $1.12 billion.

Expenditures

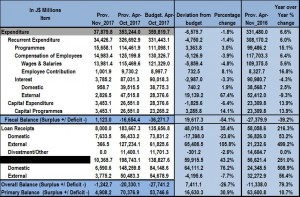

Total Expenditure for the period April to November 2017 amounted to $353.24 billion, $6.58 billion or 1.8% less than the budgeted $359.82 billion. Recurrent expenditure which totalled $326.69 billion, accounted for 92.5% of overall expenditures. Relative to projections, recurrent expenditure was $4.75 billion (1.4%) less than budgeted. Of the recurrent expenditure categories over the review period, ‘Compensation of Employees’ came in below budget by $5.13 billion, totalling $125.20 billion relative to a budget of $130.33 billion. ‘Employee Contribution’ which amounted to $9.73 billion, was $732.5 million more than projected, while ‘Wages and Salaries’ was below the projection by $5.86 billion to total $115.47 billion. ‘Interest’ closed the period under budget by 3.3%, amounting to $87.03 billion, while ‘Programmes’ was over budget by 3.0% totalling $114.46 billion (2016: $99.49 billion). ‘Capital Expenditure’ amounted to $26.55 billion for the period and was under budget by 6.4% relative to the budgeted $28.38 billion.

As a result of the decrease in expenditures for the period April to November 2017, the ‘Fiscal Deficit’ was $16.65 billion, relative to a projected deficit of $36.27 billion. Additionally, the primary balance for the period amounted to $70.38 billion, 30.9% more than budgeted.

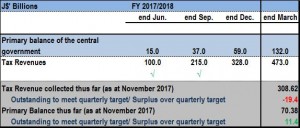

As part of the Memorandum of Economic and Financial Policies (MEFP), the GOJ estimates that the primary balance, as a performance criterion, should amount to $132.3 billion by the end of the 2017/2018 fiscal year. For the December quarter, a primary balance of $59.0 billion is estimated. As at November 2017, this amounted to $70.38 billion. Tax Revenue was expected to total an estimated $328.0 billion by the end of the December quarter, as at November 2017, tax revenue was booked at $308.62 billion.

The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.