January 3, 2023

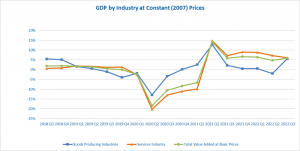

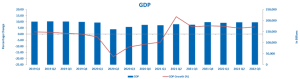

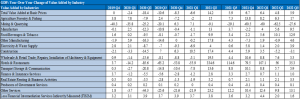

The Statistical Institute of Jamaica (STATIN) reported a 5.9% increase in Jamaica’s total value added at constant prices in the third quarter of 2022 compared to the same quarter of 2021. The Planning Institute of Jamaica (PIOJ) anticipated 4.3% quarterly increase. Services and goods-producing industries grew 6.0% and 5.6%, respectively. The economy’s recovery from COVID-19 helped performance.

Hotels & Restaurants (35.3%), Wholesale & Retail Trade; Repairs; Installation of Machinery & Equipment (5.3%), Transport, Storage & Communication (5.9%), Other Services (13.1%), Finance & Insurance Services (1.0%), Real Estate, Renting & Business Activities (3.3%), Producers of Government Services (0.1%), and Electricity & Water Supply (3.9%) all had higher activity levels.

Increased activity in hotels and other short-stay accommodation, as well as restaurants, bars, and canteens, contributed to growth in the Hotels & Restaurants industry. A 49.2% increase in foreign national arrivals impacted the hotels and other short-stay accommodation group. During the period, 597,227 foreign nationals visited the island, up from 400,184 in 2021. Increased arrivals from the United States of America (28.8%), Canada (296.2%), Europe (176.0%), and Latin America (286.4%) were primarily responsible for the higher numbers.

Recreational, cultural, and sporting activities and other services sub-industries grew the Other Services industry. Relaxed COVID-19 containment helped the recreational, cultural, and sporting activities sector. Tourist, entertainment, and gambling activities drove the expansion. Stopover and cruise passenger arrivals boosted tourism. Stopover arrivals increased 47.8% from 437,890 in 2021 to 647,295. In 2022, 224,301 cruise passengers visited the island, up 2,576.3% from 8,381 in 2021.

Electricity consumption increased 5.1% to 837,872 MWh in 2022 from 797,218 MWh in 2021 due to higher commercial consumption. In 2022, water consumption dropped 0.8% to 4,650.9 million gallons from 4,690.0 million in 2021. Residential consumption dropped most.

Within the Goods Producing Industries, higher output levels were recorded for Agriculture, Forestry & Fishing (17.0%) and Manufacturing (9.5%). The Mining & Quarrying and Construction however declined by 27.6 % and 3.1 % respectively.

Growth in Agriculture, Forestry & Fishing was the result of increases in both sub-industries, Other Agricultural Crops (which includes Animal Farming, Forestry & Fishing) and Traditional Export Crops of 17.0 % and 16.8 % respectively. The major contributory factors influencing the increase was the continuation of programmes initiated by the Government, aimed specifically at optimizing productivity and the impact of investments in crop production. Farmers also received support with marketing strategies.

The uptick within the Manufacturing industry was due to increases in both the Food, Beverages & Tobacco and Other Manufacturing sub-industries of 12.9 % and 4.6 % respectively. The growth in the Food, Beverages & Tobacco sub-industry was mainly due to increases in the production of meat & meat products, prepared animal feeds, bakery products and beverages.

However, the decline within the Mining & Quarrying industry was primarily attributed to lower output levels of alumina and crude bauxite. Despite the resumption of operations at the Jamaica Aluminium Company (JAMALCO) plant in July 2022 from the fire that occurred in August 2021, alumina production fell by 38.8 % to 167.0 thousand tonnes during the period. This reduction was reflected in a 66.4 % decline in the volume of alumina exported. The production of crude bauxite fell by 10.3 % to 577.4 thousand tonnes in 2022 compared to 643.4 thousand tonnes in 2021.

Notably, total value added grew by 2.1 % when compared to the second quarter of 2022. This was the ninth consecutive quarterly growth since the decline in the second quarter of 2020.

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.