Date: February 15, 2018

GWEST Corporation Limited (GWEST), for the nine months ended December 31, 2018 booked Total revenue amounting to $90.08 million, an increase of 46% when compared with the $61.58 million booked last year. Revenue rose by 49% or $10.72 million for the third quarter, amounting to $32.38 million (2017:$21.66 million).

Cost of sales amounted to a total of $31.33 million relative to the $12.16 million reported for the same period last year. For the quarter, cost of sales increase from $4.81 million to $9.64 million.

Consequently, gross profit increased 19% or $9.32 million to a total of $58.75 million relative to the $49.43 million for the corresponding period in 2017. There was a 35% growth in gross profit for the third quarter to amount to $22.74 million compared to $16.85 million the prior year. The company highlighted that “ these expenses as well as administrative expenses increased during the period under review as we prepared our facilities to more efficiently provide 24-hour urgent care services, increased lab services and build-out our staff complement to better serve our customers. ”

Administrative expenses increased by 103% to close the period at $144.59 million (2017: $71.40 million). For the quarter, there was an increase from $32.67 million in 2017 to $44.69 million.

Other operating expenses amounted to $1.88 million, down from $28.06 million in the corresponding period for 2017. Finance cost for the period amounted to $26.24 million relative to $28.43 million booked in for the comparable period in 2017.

GWEST reported a loss before tax of $112.25 million relative to the $76.27 million reported in 2017.

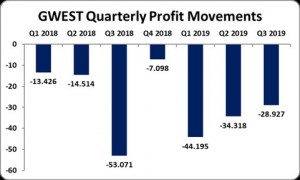

Consequently, net loss for the period amounted to $112.25 million relative to a net loss of $81.01 million in 2017; no taxes were charged for the current period. Net loss for the quarter amounted to $28.93 million (2017: $53.07 million).

Loss per share (LPS) for the period amounted to $0.23 compared to and LPS of $0.17 recorded in 2017. The LPS for the quarter amounted to $0.06 relative to an LPS of $0.11 in 2017. The trailing-twelve-month LPS amounted to $0.25. The number of shares used in the calculations is 484,848,485. GWEST closed the trading period on February 15, 2018, at $1.44.

GWEST stated, “We continue to work closely with the Ministry of Health (MOH) and the National Public Health Laboratory (NPHL) to finalize registrations that will allow us to accept health insurance cards as payment for urgent care and laboratory services. With this added payment method, we anticipate a significant increase in revenues. Our customers will be able, then, to access our services using through their health insurance provider. The first step in this process has been completed with the inspection by the MOH of our Urgent Care and Lab during the quarter and we now await the MOH’s formal registration letters to complete the process.”

Also, “In keeping with our business strategy, the company is increasing productivity and operating efficiently to enhance profitability. We have signed contracts with hotels and businesses in the Montego Bay area and continue to aggressively seek to sign new contracts with other medical service providers who are owners and tenants in the GWest Centre building that allow, the Company to market a : “one-stop” health care facility to customers. These contractual agreements will contribute to increased revenues in the near future.”

Balance Sheet at a glance:

As at December 31, 2018, total assets amounted to $1.57 million, 4% more than $1.64 billion the year prior. This was due to a 4% increase in ‘Due from related parties’ which closed at $114.13 million (2017: $31.77 million). This growth was however tempered by the Company reporting no ‘Cash and bank balances’ relative to $268.17 million in 2017.

Shareholders’ Equity totaled $744.39 million (2017: $634.60 million) resulting in a book value per share of $1.54 (2017: $1.31).

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.