February 12, 2021

GWEST Corporation Limited (GWEST), for the nine months ended December 31, 2020 booked Total revenue of $87.32 million, a decrease of 14% when compared with the $101.83 million booked last year. Revenue declined by 1% or $413,000 for the third quarter, amounting to $32.51 million (2019: $32.92 million). The company highlighted that “Revenues from leases increased quarter over quarter, but revenue from patient fees continue to underperform due to the reduction in economic and business activity brought on by the onset of the Covid-19 pandemic.”

Cost of sales amounted to a total of $18.67 million relative to the $24.81 million reported for the same period last year. For the quarter, cost of sales rose from $6.35 million to $6.70 million.

Consequently, gross profit fell 11% or $8.37 million to a total of $68.65 million relative to the $77.01 million for the corresponding period in 2019. For the quarter, there was a 3% fall in gross profit to $25.80 million compared to $26.57 million the prior year.

Over the nine month period administrative expenses declined by 2% to close at $100.28 million (2019: $102.29 million), due to the increase in expenses associated with Covid-19 protocols as stated by the Company. For the quarter, administrative expenses increased from $34.02 million in 2019 to $35.88 million in 2020.

Other operating expenses was nil for period under review (2019: $406,000), while finance cost amounted to $26.91 million relative to $37.57 million booked in for the comparable period in 2019.

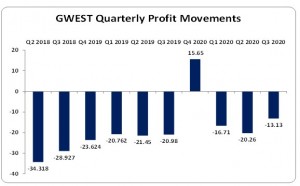

No Taxes were charged for the period. As such, net loss being comprehensive income amounted to $50.10 million relative to the loss of $63.15 million reported in 2019. Net loss for the quarter amounted to $13.13 million (2019 Loss of: $20.98 million).

Loss per share (LPS) for the period amounted to $0.10 compared to and LPS of $0.13 recorded in 2019. The LPS for the quarter amounted to $0.03 relative to an LPS of $0.04 in 2019. The trailing-twelve-month LPS amounted to $0.07. The number of shares used in the calculations is 484,848,485. GWEST closed the trading period on February 11, 2020, at $0.70.

GWEST stated, “During the quarter we started construction of our Ambulatory Surgical Centre and overnight inpatient Unit. This is projected to become operational by the second quarter of the next financial year and will result in increased revenues for our company.” Also, “We continue to see increase enquires for our investments property and we expected to see improvement in the occupancy levels in the upcoming periods.”

Balance Sheet at a glance:

As at December 31, 2020, total assets amounted to $1.60 million, 6% less than $1.71 billion the year prior. This was due to a 55% decrease in ‘Property and equipment’ which closed at $226.46 million (2019: $498.91 million).

Shareholders’ Equity totaled $617.96 million (2019: $652.41 million) resulting in a book value per share of $1.27 (2019: $1.35).

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.