May 12, 2022

Honey Bun (1982) Limited for the six months ended March 31, 2022 period reported revenues of $1.37 billion, 39% up from the $988.72 million reported a year ago. HONBUN stated that, “Our new products contributed to increased sales with tremendous demand. Investments we have made to increased distribution have also had a significant contribution to revenues and making our products more easily available island wide.”

The Company had a 57% increase in cost of sales to close at $810.69 million (2021: $516.94 million). Despite this, gross profit went up 19% or $90.95 million year-to-date to $562.73 million relative to $471.78 million reported in the prior corresponding period. Gross profit for the quarter amounted $298.14 million (2021: $253.72 million).

According to HONBUN, “The company’s margins declined for the quarter, due to continuous global price increases in key ingredients from suppliers mainly due to supply shortage and shipping challenges. Flour prices increased again in late March.”

The Company documented other gain for the six months ended March 31, 2022 totaling $1.11 million relative to gains of $3.84 million for the similar period in 2021. HONBUN reported other losses of $5.86 million for the quarter relative to gains of $4.36 million for the same quarter of 2021. Profit before operating expenses for the six months amounted $563.84 million (2021: $475.62 million) a 19% increase when compared to the same period in the previous year.

Administrative expenses rose 31% to $282.84 million (2021: $216.41 million) for the six months, while selling, distribution and promotional expenses rose by 29% to $165.19 million (2021: $128.11 million). Total expenses for the six months amounted to $448.03 million, 30% above the $344.52 million recorded for the same period of 2021. For the quarter, total expenses increased by 40% to $235.36 million (2021: $168.48 million).

The increase in expenses resulted in a 12% contraction in profit from operations, which moved from $131.10 million in 2021 to $115.81 million for the period under review.

Finance income for the six month period totalled $1.81 million (2021: $59,165), while for the quarter finance income closed at $1.04 million (2021: $33,602). The six months finance costs rose by 70% to $6.18 million (2021: $3.64 million). As for the quarter, the finance cost rose by 51% to close at $2.80 million (2021: $1.85 million).

Increase in value of investments classified as fair value through profit or loss amounted to $350,725 relative to the $231,963 reported in the prior year. No increase in value of investments classified as fair value through profit or loss was recorded for the quarter (2021: $231,963).

As such, profit before taxation closed the period at $111.79 million versus the $127.76 million booked in the same period last year. Pretax profit for the quarter amounted to $55.16 million (2021: $88.02 million).

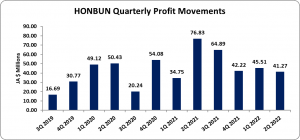

Taxation for the six months amounted to the $25.01 million (2021: $16.18 million), thus resulting in net profit after taxation of $86.78 million (2021: $111.58 million). For the quarter, net profit fell to $41.27 million compared to the $76.83 million reported in the previous comparable quarter. HONBUN noted, “The decline in net profits was attributable to a number of factors, the rise in raw material costs absorbed by the company and re-positioning to increase distribution channels being two major factors.”

Consequently, earnings per share (EPS) amounted to $0.18 (2021: $0.24) year to date, while for the quarter the EPS amounted to $0.09 (2021: $0.16). The trailing twelve months EPS is $0.41. The number of shares used in this calculation was 471,266,950 shares. HONBUN last traded on May 12, 2022 at $9.35 with a corresponding P/E of 22.73 times.

Balance Sheet at a Glance:

As at March 31, 2022, total assets increased by 20% to close at $1.40 billion (2021: $1.17 billion). The increase was largely due to increases in ‘Inventory’ and ‘Receivables’ which closed at $158.41 million (2021: $74.73 million) and $154.80 million (2021: $81.01 million), respectively. HONBUN noted, “in our continued focus on improving manufacturing technologies and expanding our distribution network, the six months-to-date the company investing an additional $63.3 million in property plant and equipment and intangible assets. This was mainly for additional distribution vehicles and software/business intelligence upgrades.”

Shareholders’ equity totalled $1.06 billion compared to the $938.73 million quoted as at March 31, 2021. This resulted in a book value of $2.24 relative to $1.99 the prior year.

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.