January 27, 2022

According to the latest report provided by the Eurostat, in the third quarter of 2021, household real consumption per capita rose by 4.1% in the euro area, after an increase in the previous quarter by 3.6%. However, during the third quarter of 2021 household real income per capita rose slightly by 0.1%, after an increase of 1.1% during the second quarter of 2020.

Furthermore, in the EU household real consumption per capita rose by 4.1% in the third quarter of 2021, after an increase of 3.4% in the previous quarter. On the other hand, household real income per capita increased by 0.9% in the third quarter of 2021, after an increase of 0.5% in the previous quarter of 2021.

Household gross disposable income and its components, during the third quarter of 2021 increased by 0.7% in the euro area and 1.8% in the EU. Eurostat stated, “The largest positive contributor was compensation of employees (received), while gross operating surplus and gross mixed income and net property income and other net current transfers also contributed positively. At the same time, social benefits and current taxes and net social contributions contributed negatively.”

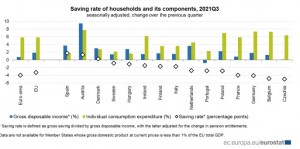

As a result of the increase in individual consumption expenditure and increase in disposable income, household saving rate decreased in both the euro area and EU by 4.0 percentage points and 3.3 pp compared to the second quarter of 2021, respectively. Eurostat noted, “The highest decreases were observed in Czechia (-5.0 pp), Belgium (-4.8 pp), Germany (-4.1 pp) and France (-4.0 pp). At the same time, it slightly increased in three Member States: Spain (+1.7 pp), Austria (+1.3 pp) and Denmark (+0.2 pp). The decrease in saving rate in the majority of Member States is explained by the increase of individual consumption expenditure at a faster pace than gross disposable income.”

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer(s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view(s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.