February 17, 2020

iCreate Limited (ICREATE) for the year ended December 31, 2019 reported revenues of $48.28 million, up from the $31.85 million reported a year ago. For the fourth quarter, ICREATE posted $6.88 million in revenue (2018: $2.41 million).

Management noted, “This strong revenue growth was attributable to increased physical capacity at the Kingston location and the opening of our Montego Bay branch during the year.”

Total direct costs amounted to $14.80 million for the twelve months period compared to $11.84 million for the twelve months of 2018. Thus, resulting in gross profit of $33.48 million relative to $20.01 million booked last year. Gross profit for the quarter amounted to $3.01 million versus $1.60 million booked for the fourth quarter of 2018. Other income for the year end amounted to $559,258 relative to $119,790 for 2018, while the other income for the quarter totalled $4,499 (2018: $117,219) for other income.

Administrative expenses rose 98% to $63.41 million (2018: $32.06 million) for the year ended 2019. Depreciation and amortization expense increased year over year to close at $3.13 million versus $1.05 million recorded for the corresponding period in 2018.

Management stated, “increased legal, professional and regulatory fees associated with listing on the Jamaica Stock Exchange, increased expected credit losses relating to receivables and increased depreciation charges arising from investment in training equipment and leasehold improvement at the Kingston and Montego Bay locations, adversely impacted the bottom line.”

As such, operating loss for the period closed at $32.50 million in contrast to a loss of $15.07 million for the corresponding period of 2018. Operating loss for the fourth quarter closed at $21.07 million (2018: $10.17 million).

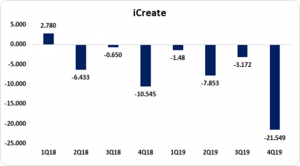

Finance cost for the year ended December 31, 2019 amounted to $1.56 million relative to $2.09 million a year ago. No taxes were recorded for the period. Consequently, net loss for the year ended December 2019 amounted to $34.06 million versus a loss of $14.85 million in 2018. For the fourth quarter, net loss totalled $21.55 million compared to $10.54 million booked in the corresponding quarter last year.

iCreate noted, “This was due primarily to lower than expected revenue in the fourth quarter as a result of the timing of a few contracts slated to finalize in the fourth quarter of 2019 which will not materialize until the first quarter of 2020”.

Additionally, Management highlighted, “, the company performed an assessment of its receivables and increased its credit loss provisions by $8.3 million, which was recorded in the fourth quarter.”

Loss per share (LPS) amounted to $0.17 compared to a LPS of $0.08 for the same period of 2018. The loss per share for the quarter amounted to $0.11 relative to $0.05 reported in 2018. The number of shares used in this calculation was 197,592,500 shares. iCreate traded on February 17, 2020 at $0.77.

iCreate noted, “Notwithstanding the overall performance in 2019, the company’s significant capital investment in training equipment and physical capacity in 2019 has positioned the company for growth in revenue and profitability in the coming years. The outlook for iCreate is positive, we made some bold decisions in 2019, including the decision to increase our provision for credit losses. With our infrastructure now at 100% completion, we expect a positive return on investment as we strategically increase market penetration, diversify our product offerings, and create key partnerships.

Management outlook highlighted that, “Montego Bay continues to show good signs of growth and we have also expanded into Trinidad and Tobago which started recording revenues in just one month of launch.”

Balance Sheet at a Glance:

As at December 31, 2019, total assets increased to close at $42.19 million (2018: $14.82 million). The increase was largely due to a $14.44 million growth in ‘Property, Plant & Equipment’ which closed at $20.54 million (2018: $6.10 million) as well as a 73% increase in ‘Trade and other receivables’ which closed at $9.29 million (2018: $5.37 million).

Shareholder’s equity totalled $5.16 million compared to a shareholders’ deficit of $14.35 million quoted as at December 31, 2018. This resulted in a book value per share of $0.026 (2018 shareholders’ deficit per share: $0.073).

Analyst Certification -This research report is for information purposes only and should not be construed as a recommendation. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may affect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.