January 17,2018

Business Confidence Index

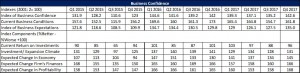

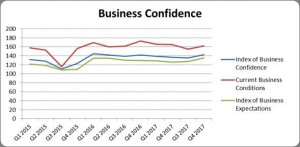

Business Expectation is at its second highest level since the start of the study in 2001. The Jamaica Chamber of Commerce(JCC) index for Business Confidence in the fourth quarter of 2017 rose to a high of 142.6 from 135.2 recorded in the third quarter of 2017. The Business Confidence index was only higher in the first quarter of 2016 when the index recorded an all-time high of 144.6. According to the study, “apart from their natural optimism as business owners (29%), confidence in the economy is also largely due to their conviction that the economic indicators are moving in the right direction as well as confidence in the strategies that have been put in place to tackle crime.” The study also highlights, “crime and violence is still seen as the number one problem facing the country at this time though marginally lower by 4% points than the previous quarter.” The improved business confidence was influenced as a result of improved Business Expectations, further confirming the business sector’s confidence in the Government Policies.

Heightened expectation for the economy

Fifty-eight percent of firms expect an improve economy in the fourth quarter of 2017 when compare to third quarter. However, this is a reduction of the number that expected the economy to improve in first quarter 2016 when the government first announced its economic policies. This increase to 58% in the last quarter of 2017 is a regaining of some confidence among the business sector

Robust investment plan continues

The willingness by firms to invest in new plant and equipment remained near its all-time high since the start of 2016. According to the study, “in the fourth quarter of 2017, 58% reported that it was a good time to expand their capacity to take advantage of future opportunities, just below the 62% set in the second quarter of 2016.”

Growth in financial prospects

Approximately 73% of firms expect to increased gains for the year ahead, an improvement by 7% from the previous quarter. The portion of firms which anticipate a worsening of the situation fell from 7% to 6% in the quarter.

Profits as expected

The portion of firms with profits exceeding expectations rose from 14% in the third quarter to 22% in the final quarter of 2017, while the number of firms that reporting disappointing profits was unchanged at 26%.

See diagram blow:

Consumer Confidence Index

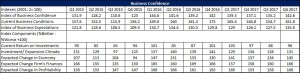

In the last two year Consumer Confidence Index hovers at an average of 149 points. The index rose from 138.7 points set in the first quarter of 2017 to 148.0 for the fourth quarter of 2017. According to the study, “the data collected suggests that consumers are uncertain about where the economy will be in the next twelve months with 2% points more expecting it to be better but an identical 2% points more expecting it to get worse.” Views about job market was unchanged, as 71% of participant believe jobs are in short supply, while close to 30% believe jobs are either adequate or plentiful. All this, while the percentage of consumer expecting a improve standard of living increase to an all-time high of 77%.

Continued economic growth

Consumers assessment of the domestic economy remained stable from its 2001 high. Three-in-four consumers assess the economy as being good or average, while 30% still anticipated a worsening economy in the fourth quarter.

Ambivalence about future job prospects

In the fourth quarter of 2017 consumers are equally likely to be convinced about an improvement in future jobs(34%) as they are about a worsening of future jobs(33%). According to the survey, “this represents a slight departure from the third quarter which showed 36% expecting improvement in jobs compared to 31% who expected a worsening. It should not be ignored however that the job outlook remained positive and has been consistently favourable since first quarter 2017.”

Income expectation remains strong

Approximately 48% of consumers anticipated income gains for the 4th quarter 2017; while only 12% expected a decline. Just about half of the consumers are either receiving more of the same amount of remittances as they did three years ago(51%), while as many as 49% are receiving less remittances.

Reduce purchase plan

The survey highlighted, “while home buying plans remained virtually unchanged(11% v/s 12%), vehicle buying intentions declined from 18% to 14% and vacation intentions declined from 36% to 29%.”

See diagram below: