November 29, 2019

Jamaican Teas Limited (JAMT) reported a 27% decrease in revenues to total $1.29 billion (2018: $1.77 billion). For the quarter, revenues amounted to $284.87 million (2018: $422.12 million). JAMT highlighted that, “JTL’s fourth quarter revenues from manufacturing operations increased almost 4 percent for the quarter from $272.8 million to $282.5 million due to increased export sales partly offset by lower domestic sales. Supermarket sales show a decline for the quarter from $121 million to $ nil, as a result of the transfer of our supermarket to our associated company, Bay City Foods Ltd (BCF) on Feb 1, 2019. BCF has contributed over $12.6 million to the Group’s interest income over the last 8 months (versus nil in the prior year to date) plus a further $2 million share in the company’s net income.”

JAMT further indicated that, “Our main tea business held its own even as we suffered a temporary setback in sales in the USA market due to our main distributer there right sizing its inventories.”

Cost of sales decreased by 34% to $946.48 million (2018: $1.43 billion). As a result, gross profit grew 3% to $347.51 million (2018: $337.61 million). For the quarter, gross profit closed at $68.56 million relative to $87.71 million reported in the previous corresponding quarter. The company mentioned that, “for the year gross profits improved by $10 million due mainly to the non-recurrence of the losses reported at Orchid Estates in 2018.”

Other income increased grossly by 422% to $553.73 million versus $106.17 million in the prior year. Within the quarter, other income rose drastically to close at $346.81 million (2018: $41.98 million). The movement in the period was due to Fair value Gain on Investments of $377.27 million (2018: nil). For the quarter, Fair value Gain on Investments closed at $250.98 million (2018: nil).

Administrative expenses increased by 26% to $227.56 million for the year ended September 2019 relative to $180.73 million for the same period of 2018. Sales and Marketing costs went up by 22% totaling $51.53 million (2018: $42.31 million). For the quarter administrative expenses and sales & marketing costs closed at $86.63 million (2018: $51.47 million) and $11.45 million (2018: $11.49 million) respectively. The Company noted, “the increase in administration expenses for both the quarter and the year to date primarily reflects accrued management incentive costs at QWI following the company’s incorporation in Dec 2018.”

Finance cost for the year amounted to $29.49 million relative to $18.75 million reported in 2018.

Pre-tax profits went up by 193% for the year end, increasing from $202.85 million in 2018 to $594.42 million in 2019. For the quarter, pretax profit amounted to $304.99 million (2018: $62.83 million).

Taxation for the year amounted to $107.41 million in contrast to $9.59 million in 2018. Net profit for the year increased to $487.01 million relative to $193.26 million recorded twelve months earlier. Profit for the fourth quarter closed at $219.25 million (2018: $55.05 million). JAMT stated that, “The outstanding performance achieved is due to a number of initiatives taken in prior periods bearing fruit in the fiscal year ended in September. For this quarter we reported realised investment gains of $8 million (versus almost $4m in the group’s year ago quarter) and fair value gains of $250 million (versus unrealized gains of $44 m in the group’s year ago quarter).”

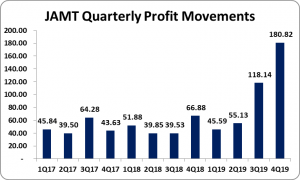

For the year end, net profit attributable to shareholders climbed to $399.67 million (2018: $198.55 million). While for the quarter, net profit attributable to shareholders went up totaling $180.82 million compared to $59.55 million in the prior comparable quarter.

Consequently, earnings per share totaled $0.58 compared to $0.29 for the year ended September 30, 2019, while for the quarter, the EPS was $0.26 (2018: $0.086). The numbers of shares used in the calculations are 695,083,459 units. JAMT last traded on November 29, 2019 at $6.09.

Management mentioned, “In October 2019 JTL purchased the 50% of BCF it did not already own. As a result, BCF became a wholly owned subsidiary of the Group and the Group’s future earnings reports will once again include the sales and profits of the Shoppers Delite supermarket. In 2019 we accounted for BCF as an associated company and only showed our share of its profit and net assets in our financial statements. Sales at the supermarket in October were ahead of October 2018.”

Balance Sheet at a glance:

As at September 2019, the Company’s total assets amounted to $4.02 billion, an increase of 131% when compared to the $1.74 billion reported as at September 2018. This growth was driven primarily by 195% growth in ‘Investments’ from $461.74 million in 2018 to $1.36 billion for the period under review. Also, ‘Other Receivables’ and ‘Investment Property’ contributed to the increase, closing at $1.24 billion (2018: $64.21 million) and $312.89 million (2018: $183.50 million), respectively.

JAMT stated, “Between June and Sept 2019 QWI borrowed over $400 million to fund its investments and this was included in Accounts Payable at year end. These purchases together with over $300 million in fair value gains recognized in the same period contributed to the significant growth in the Groups quoted investments holdings to $1.3 billion. $1.192 Billion, being the proceeds of QWI’s IPO, are included in Other Receivables at the year end. These monies were received in October 2019, after the year end.”

Shareholders’ Equity totalled $1.57 billion as at September 30, 2019 (2018: $1.25 billion), resulting in a book value per share of $2.26 (2018: $1.79).

Disclaimer: Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.