November 15, 2021

Jamaica Producers Group Limited (JP), for the nine months ended September 30, 2021 experienced a 21% increase in revenue to total $17.98 billion compared to the $14.84 billion reported in 2020. The Company posted 24% increase in third quarter revenue to $6.58 billion (2020: $5.32 billion).

The Food & Drink Division was the largest contributor to revenue for the group, ending at $10.76 billion (2020: $9.02 billion). The Company highlighted that, “During the Third Quarter, JP acquired a 50% joint venture interest in Co Beverage Lab S.L. (“CoBeverage”), an emerging fresh juice manufacturer operating in Spain. This acquisition allows the Group to deploy its expertise in vegetable and fruit juice extraction and bottling to the development of business opportunities in Southern Europe”

The Logistics and Infrastructure Division accounts for the major share of the Group’s net assets and, in turn, its profits. Divisional year-to-date revenues of $7.22 billion (2020: $5.82 billion), up 24% over the prior year.

The Corporate Services division earned revenue of $3.38 million relative to $1.82 million in 2020.

The Cost of Operating Revenue for the nine months increased by 18% to total $12.70 billion compared to $10.72 billion reported for the comparable period in 2020. Gross Profits increased to total $5.28 billion, a 28% uptick relative to the $4.12 billion documented in 2020. Gross profit for the third quarter amounted to $1.99 billion compared to $1.40 billion booked for the same quarter of 2020. Other income decreased to $438.63 million, a 12% contraction relative to $498.15 million booked the prior corresponding period.

JP’s marketing, selling and distribution expenses closed at $2.89 billion, a 10% increase when compared to the $2.64 billion booked a year earlier. As such, profit from operations amounted to $2.82 billion relative to $1.98 billion booked for the corresponding period in 2020. Profit from operations for the quarter amounted to $1.08 billion compared to $674.20 million reported for the corresponding quarter of 2020. JP also recorded a share of point in joint venture and associated company of $127.78 million relative to $4.13 million in the previous year.

Finance cost was reported at $170.29 million for the period relative to the $213.76 million reported in 2020. This resulted in a profit before taxation of $2.78 billion for the period (2020: $3.53 billion). Profit before tax for the third quarter totalled $1.12 billion versus $2.37 billion reported for the same quarter of 2020.

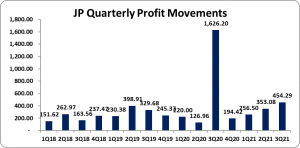

The Company incurred tax charges of $499.85 million (2020: $361.97 million). Consequently, Net Profit for the period fell 28% to $2.28 billion (2020: $3.17 billion). Net profit for the quarter amounted to $937.84 million versus the $2.23 billion booked a year prior. Notably, Net profit attributable to stockholders totalled $1.06 billion; this compares to $1.97 billion, a 46% decline. Net profit attributable to shareholders for the quarter went down to $454.29 million (2020: $1.63 billion).

Total comprehensive income for the period under review closed at $2.29 billion (2020: $3.62 billion). While for the quarter, total comprehensive income totalled $790.02 million (2020: $2.36 billion).

Earnings per share for the period amounted to $0.95 (2020: $1.76). EPS for the quarter amounted to $0.40 (2020: $1.45), while the twelve-month trailing earnings per share amounted to $1.12. The number of shares utilized in the computations amounted to 1,122,144,036 units. JP stock last traded on November 15, 2021 at $22.61 with a corresponding P/E of 20.16 times.

JP noted, “Subsequent to the end of the Third Quarter, we acquired a 50% interest in Grupo Alaska, S.A. This ice and bottled water business – based in the Dominican Republic –operates at the heart of the largest and fastest growing consumer market in the Caribbean. Along with our joint-venture partner, we are convinced that this market presents a major prospect for long-term regional growth in consumer goods and services. Our Tortuga International and JP Snacks businesses already have a strong engagement with the Caribbean consumer, and we are excited to have this additional platform.”

Balance Sheet Highlights:

As at September 30, 2021, the Company’s Assets totalled $43.44 billion, 5% more than its value of $41.51 billion a year ago. This increase in total assets was due largely to increases in ‘Securities purchased under resale agreements’ and ‘Property, Plant and Equipment’, which amounted to $9.06 billion (2020: $5.81 billion) and $22.90 billion (2020: 22.36 billion) respectively.

The Company ended the period with equity attributable to equity holders of the parent in the amount of $17.19 billion relative to $16.24 billion in 2020. The company now has a book value per share of $15.32 versus $14.47 in 2020.

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.