First three months ended March 31, 2017 results Key Insurance Company Limited (KEY), reported a 61% increase in net premiums written from $123.35 million to $199.17 million. This was as a result of a 49% increase in gross premiums written from $198.58 million to $295.93 billion. Reinsurance cede for the first quarter increased 29% to close at $96.76 million (2016: $75.23 million). KEY booked change in unearned premium reserve of $$30.98 million relative to $5.43 million last year. The company noted, “we continue to experience growth in both its non-motor and motor portfolios but a significant increase in the size of our motor portfolio was particularly notable. Non-motor gross premiums income increased by 38.41% over last year’s results and Motor gross premiums income increased by 59% over the same period last year.”

As such, net premiums earned increased by 43% from $117.92 million for the first three months of 2016 versus $168.19 million for the comparable period in 2017. Changes in insurance reserves for the quarter improved from a deficit of $1.03 million in 2016 to $3.43 million, while commission income rose 37% to $18.33 million (2016: $13.42 million).

The company reported $27.61 million for commission expense relative to $15.94 million, a 73% increase year over year. Claims expense totalled $98.60 million, up 74% from the $56.57 million recorded in 2016. Key indicated, “the company continues to experience a corresponding increase in its claims portfolio as the company grows in the number of policies underwritten. Our claims portfolio has seen approximately a 74% increase in the first quarter of the year in comparison with the similar period in 2016. However, we remain committed to maintaining efficiency in the handling of claims by ensuring prudent reserving and settlement practices.”

Administration and other expenses increase for the quarter by 9% to $93.20 million (2016: $85.88 million). There was an underwriting loss of $18.48 million for the quarter compared to $12.26 million reported in 2016.

Key booked a 32% in investment income to $15.15 million (2016: $11.51 million), while other income declined 83% to $610,000 relative to $3.66 million.

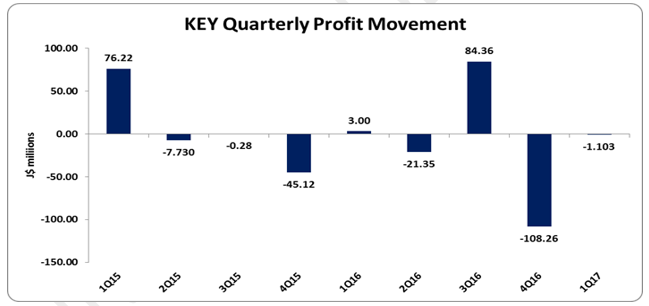

The company reported a loss before taxation of $2.72 million for the period compared to a profit of $2.91 million for the comparable 2016 period.

Following tax credit of $1.62 million (2016: $15,000), the company booked a loss for the year of $1.10 million compared to a profit of $2.90 million in 2016.

Loss per share for the first quarter amounted to $0.003 relative to earnings per share of $0.008 in 2016. The trailing earnings per share totalled $0.13. The number of shares used in the calculation was 368,460,863 units.

Management indicated that several projects have been undertaken designed to reduce costs such as utility. The project will see, “the replacement of inefficient air cooling systems with more cost effective inverter air conditioning models and the changing of lighting to energy saving LED across the organization.” Key also reiterated that, “the company’s capital base remains strong and our Management Team remains committed to the company’s profitability and growth.”

Balance Sheet Highlights:

The company’s total assets amounted to $2.33 billion as March 31, 2017 up from $1.20 billion as at March 31, 2016, representing a 16% increase. Investment securities’ and ‘Due from reinsurers’ contributed to the increased figure with a 53% and 79% increase year over year.

Total Stockholders’ Equity as at March 31, 2017 was $1.02 billion (2016: $996.58 million), resulting in a book value of $2.78 (2016: $2.70).

Disclaimer:

Analyst Certification -This research report is for information purposes only and should not be construed as a recommendation. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.