August 15, 2022

Kingston Properties Limited reported rental income of US$1.62 million, 12% more than the US$1.44 million reported for 2021. However, for the quarter, there was a 13% rise from US$727,420 in 2021 to US$818,526 for the period under review. KPREIT noted, “the higher year on year figure was mainly due to increases in rents at some of our properties, as well as higher occupancy levels at our properties in Jamaica.”

Operating expenses rose 28% to US$733,056 relative to the US$571,820 posted for the same period last year. “The increase is mainly as a function of higher year over year staff costs, due to the increase in our staff complement and higher broker and professional fees which were both one-off expenses recorded during the period. However this was offset by lower homeowners’ association dues and property taxes in the US consequent on the continued disposal of our condo units in Florida” as per KPREIT.

As such, results of operating activities before other gains amounted to US$883,240 relative to US$865,295 posted last year. While, for the quarter, results of operating activities before other gains closed at US$407,743 (2021: US$427,635).

Gain on disposal of investment property totalled US$225,794 for the period relative to the previous year’s loss of US$19,257. Increase in fair value of other investments amounted to US$117,299 (2022: $201,038).

Miscellaneous income amounted to US$20,377 (2021: US$77,799). There was no impairment gain/loss on financial assets for the period under review. Management fees amounted to US$41,339, 14% above 2021’s US$36,136.

Operating profit closed the six months period at US$1.35 million (2021: US$1.16 million). For the quarter, operating profit amounted to US$432,704 (2021: US$487,578).

Net finance costs closed at US$263,741 relative to net finance cost of US$207,987 for the six months ended June 2021. Of this, finance cost and finance income amounted to US$399,000 (2021: US$244,901) and US$135,259 (2021: US$36,913), respectively.

This resulted in a profit before taxation of US$1.08 million, compared to the US$953,023 booked in 2021. Profit before tax for the quarter amounted to US$370,925, relative to the US$326,127 booked in 2021.

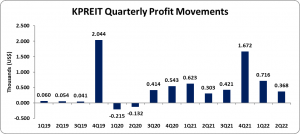

Tax charge for the six months amounted to US$104 (2021: US$25,822). This resulted in a net profit of US$1.08 million relative to the US$927,201 booked in the comparable period last year. Net profit for the quarter amounted to US$367,925 (2021: US$302,703).

Moreover, total comprehensive income for the six months was US$1.08 million (2021: US$927,201).

Earnings per share (EPS) for the six months ended June 30, 2022 amounted to US0.123 cents for the period (2021: US0.105 cents). For the quarter, EPS amounted to US0.042 cents for the period (2021: US0.034 cents). The trailing twelve months EPS amounted to US0.36 cents. The number of shares used in our calculations is 884,609,294. Notably, KPREIT stock price close the trading period on August 12, 2022 at J$7.02 with a corresponding P/E of 12.90 times.

KPREIT stated, “the diverse nature of our tenant base and geographic diversity continues to offer a level of resilience to our operating income. Further, the deployment of funds raised over the last three years continues to ensure solid results through acquisition of higher yielding assets and improved efficiency in our operations. This is demonstrated by our 5-year compound annual growth rate (CAGR) for rental income and net operating income being 14% and 25%, respectively. We will continue the divestment of the condo portfolio in Florida and this will result in a shift into multifamily properties to reduce valuation volatility and generate higher yields.”

Balance Sheet at a glance:

As June 30, 2022, assets totalled US$57.41 million, 28% more than the US$45.01 million booked as at June 30, 2021. The growth was mainly due to the 249% increase in ‘Cash and cash equivalents’ to US$7.63 million (2021: US$2.19 million) and 322% increase in ‘Investment in Real Estate Fund’ to US$5.26 million (2021: US$1.25 million). The movement was offset by a decline in ‘Restricted Cash’ to US$1,969 (2021: US$482,049).

KPREIT noted that “following the acquisition of several properties over the last twelve months, and the disposal of seven (7) condo units over the same period, investment properties (excluding properties held for sale) remained relatively flat year on year at $40 million. Two condo units totalling a carrying amount of $1.8 million were held for sale in South Florida during the first half of 2022. During the current period the Group also invested $1.8 million in Polaris at East Point resulting in an increase of 321.8% to $5.3 million in our Investment in Real Estate Funds.”

Shareholders’ equity closed at US$42.84 million, up US$11.85 million from last year’s US$30.99 million, resulting in book value per share of US$0.05 (2021: US$0.04).

Disclaimer:

Analyst Certification – The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure – The information contained herein has been obtained from sources believed to be reliable, however, its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may affect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.