July 17, 2023

Caribbean Cream Limited (KREMI) for the first quarter ended May 31, 2023 reported a 1% decrease in revenue totalling $603.99 million compared to $611.75 million in the corresponding three months last year.

Cost of Sales amounted to $418.17 million (2022: $447.36 million), this represents a decrease of 7% year over year. Consequently, gross profit increased by 13% to $185.82 million compared to $164.39 million for the first quarter ended May 31, 2022.

Administrative expenses increase by 8% to close at $147.82 million (2022: $136.84 million), while selling and distribution costs decrease by 8% from $14.94 million in 2022 to $13.80 million for the current three months. As a result, Total Expenses for the first quarter amounted to $161.63 million, a 6% increase relative to $151.78 million reported in 2022.

Operating Profit for the three months amounted to $25.38 million, a 89% increase relative to $13.42 million reported in 2022. Finance costs totalled $17.72 million, a 49% increase from the corresponding period last year (2022: $11.90 million).

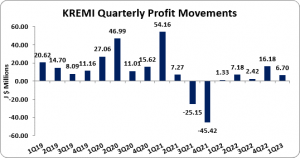

Profit before taxation for the first quarter ended May 31, 2023, amounted to $7.65 million, a 405% increase relative to $1.51 million reported in 2022.

Taxation for the three months had a 405% increase to reach $956,677 (2022: $189,312). Net Profit for the three months amounted to $6.70 million, a 405% increase from the $1.33 million reported in 2022.

Consequently, Earnings Per Share for the three months amounted to $0.02 (2022: EPS: $0.004). The twelve-month trailing EPS was $0.09 and the number of shares used in these calculations was 378,568,115. Notably, Kremi’s stock price closed the trading period on July 14, 2023 at a price of $4.07 with a corresponding P/E ratio of 47.62x.

Balance Sheet Highlights

The company’s assets totalled $2.30 billion (2022: $1.78 billion). ‘Property, Plant & Equipment’ contributed to the increase closing at $1.65 billion (2022: $1.25 billion).

Shareholder’s equity was $832.31 million (2022: $799.83 million), representing a book value per share of $2.20 (2022: $2.11).

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.