Date: July 17, 2018

Lasco Financial Services Limited (LASF), for the three months ended June 30, 2018, recorded for the three months ended June 30, 2018, a total of $526.05 million in Trading Income; this represented a growth of 74% relative to the $302.68 million recorded in the comparable quarter in 2017. According to the Company, this was “driven by our growth in transactions.” The Company also highlighted , “Of note for this financial period is the positive contribution of the newly acquired LASCO Microfinance Limited. Just above half of the increase in income was contributed by loans”. Other Income for the quarter also amounted to $28.47 million, a rise of 72% compared to $16.54 million in 2017. Consequently, this resulted in an overall gross profit of $554.51 million for the quarter, a growth of 74% compared to $319.23 million in 2017.

Operating Expenses for the period amounted to $382.26 million which is 62% more than the $235.93 million recorded in June 2017. Selling and Promotional Expenses increased 49% to close at $181.79 million relative to $122.21 million in 2017, while Administrative Expenses rose 76% to close at $200.46 million (2017: $113.72 million).

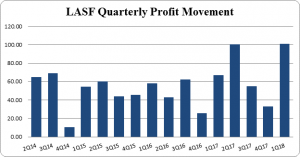

As a result, Profit from Operations for the period grew by 107% to total $172.26 million relative to $83.30 million that was recorded in the prior period in 2017.

Finance Cost amounted to $40.70 million for the quarter (2017: $2.51 million) a gross increase of 1792%. We will be contacting Management for an explanation on this increase. This resulted in Profit before Tax of $131.56 million, a 62% increase comparative to $81.15 million in 2017.

After taxation of $31.04 million (2017: $14.28 million), Net Profit for the quarter amounted to $100.52 million which was a 50% growth from the prior period’s net profit of $66.87 million.

Earnings per Share for the quarter amounted $0.08 (2017: $0.05). The number of shares used in the calculation was 1,264,694,391. The twelve months trailing EPS is $0.23. The stock price as at July 16, 2018 closed at $5.05.

The Company noted “Subsequent to the financial year end, LFSL embarked upon a re-organization whereby it’s Loans Division was merged with LASCO Microfinance Limited, giving rise to a large loan company with a powerful brand presence through thirteen (13) branches island wide. The focus of the newly organized group will be allocated such that LFSL; the parent will concentrate on its core activities, Cambio and Remittance services in Jamaica and LASCO Microfinance limited will focus on providing credit in pursuit of financial inclusion.”

Balance Sheet Highlights:

As at June 30, 2018 the company’s assets totaled $3.55 billion, $2.01 billion more than its value a year ago. This increase in total assets was largely driven by increases in ‘Receivables’ and ‘Intangible Assets’ which closed at $1.85 billion (2017: $709.47 million) and $841.39 million (2017: $24.72 million) respectively. However, ‘Short term Deposits’ drastically declined by 78% from $371.83 million to total $81.75 million.

Total Stockholders’ equity as at June 30, 2018 closed at $1.47 billion an increase of 20% compared to the $1.22 billion reported in 2017. This resulted in a book value per share of $1.16 (2017: $0.97).

Disclaimer: Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein