November 2, 2020

Lasco Financial Services (LASF), recorded for the six months ended September 30, 2020, a total of $1.15 billion in Trading Income; this represented a 6% decline relative to the $1.22 billion recorded for the comparable period in 2019. LASF stated, “The 5.7% decline is largely due to the fall in revenues from our Subsidiary Loan company by $152.2 million, a reduction of 34.5% when compared with the previous financial period. There was, however, a compensating increase of $50.4 million or 11% increase in revenues from remittance transactions and a $33.5 million or 10.8% increase in Cambio Revenues. The loan business continues to experience the residual impact from the effects of the COVID pandemic, whereas the money service business showed strong quarterly growth.” For the quarter, Trading Income closed at $614.61 million (2019: $630.06 million), a fall of 2% year over year.

Other Income for the six months period amounted to $8.05 million significantly lower than $92.28 million booked in 2019. Consequently, this resulted in an overall income of $1.16 billion for the six months, a decrease of 12% compared to $1.31 billion in 2019.

Operating Expenses for the period closed at $960.90 million, which is 9% less than the $1.06 billion recorded in September 2019. Of this, Administrative Expenses decreased by 1% amounting to $523.10 million relative to $530.33 million in 2019, also, Selling and Promotional Expenses declined 17% to close at $437.79 million (2019: $530.59 million). Management stated, “At the onset of the COVID pandemic several initiatives were put in place to control non-essential expenditure, as such there was a 32% reduction in expenses in the quarter.”

As a result, Profit from Operations for the period fell by 21% to total $194.78 million relative to $247.23 million that was recorded for the corresponding period in 2019. While for the second quarter, Profit from Operations increased by 215% closing at $216.82 million (2019: $68.92 million).

Finance Cost amounted to $95.09 million for the period (2019: $96.06 million), a decrease of 1%. As for the second quarter, Finance Cost totaled $45.33 million versus $47.50 million in the prior comparative quarter.

Profit before taxes amounted to $99.69 million in 2020 relative to $151.17 million in 2019, a 34% drop year over year. For the quarter, profit before taxes closed at $171.50 million (2019: $21.42 million).

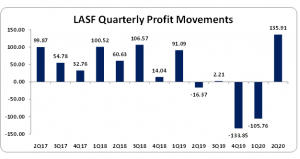

After taxation of $69.53 million (2019: $76.45 million), Net Profit for the six months ended September 30, 2020 amounted to $30.15 million, declining by 60% from the prior year’s comparable period Net Profit of $74.72 million. Also, for the second quarter, LASF booked net profit of $135.91 million versus net loss of $16.37 million in the previous comparable period.

LASF noted, “Contributing to the improvement in performance is the decision by the business to place its focus on assisting its existing customers to navigate their business challenges using moratoriums and cash preservation strategies. There will now be a shift towards lending again, however, as opportunities for lending are now beginning to manifest as businesses are adjusting to the new normal, with some embracing new opportunities.”

Earnings per Share (EPS) for the period amounted to $0.024 (2019: $0.059), while for the quarter, the EPS amounted to $0.11 (LPS 2019: $0.01). The twelve months trailing LPS is $0.08. The number of shares used in the calculation was 1,270,094,391 units. The stock price as at October 30, 2020 closed at $2.06.

Additionally, LASF highlighted, “The general direction of the LASF group is an indication of the growth potential and sustainability of our business model: financial Inclusion, micro finance and micro payments. As such, we were pleased to participate in the disbursements of the Government of Jamaica’s CARES Grants through our well diversified agent network during the quarter. Also, over the course of the pandemic and continuing, we were able to display our diversity in payment services, allowing customers to receive remittances directly to their bank accounts as well as to their LASCO Pay prepaid card, serving our customers in store and online. While we progressively enable our customers towards digital services, LASF will continue with its blended operations to support its large cash network to bring value to our agents on a sustained basis.”

Balance Sheet Highlights:

As at September 30, 2020, the Company’s assets totaled $3.98 billion, $127.88 million less than its value a year ago. This decrease in ‘Total Assets’ was largely driven by decreases in ‘Loans and Receivables’ which closed at $1.62 billion (2019: $2.64 billion).

Total Stockholders’ equity as at September 30, 2020 closed at $1.57 billion, a decrease of 6% compared to the $1.67 billion reported in 2019. This resulted in a book value per share of $1.24 (2019: $1.32).

Disclaimer:

Analyst Certification –The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure –The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.