May 12, 2023

MailPac Group Limited (MAILPAC)’s revenue amounted to $398.01 million for the three months ended March 31, 2023, relative to $398.46 million booked in 2022. Cost of sales totalled $206.98 million (2022: $215.64 million). Gross profit amounted to $191.03 million for the period under review, 4% higher than $182.83 million booked for the corresponding quarter. The growth in profitability stemmed from the efficiency initiatives over the past year as well as greater affinity and shopping frequency within MAILPAC’s existing customer base.

Administrative and general expenses amounted to $96.77 million (2022: $90.43 million) for the three months, while selling and promotion costs totalled $18.42 million (2022: $24.50 million). Thus, operating expenses for the quarter amounted to $115.19 million, up from $114.93 million booked in 2022, as the company continued to improve efficiency in the management and ultimate delivery of their packages.

Consequently, the Company booked an operating profit of $75.84 million, a 12% rise from the $67.90 million recorded twelve months earlier.

Other income amounted to $586,471 million (2022: $7.10 million) for the quarter ended March 31, 2023.

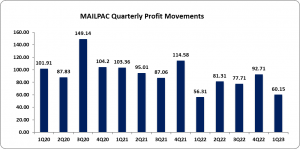

Finance and policy costs for the quarter totalled $16.27 million, down from $18.69 million booked in the prior comparable period. Consequently, MAILPAC booked profit before taxation of $60.15 million for the three months ended March 31, 2023, relative to $56.31 million booked for the previous corresponding period.

There was no taxation incurred due to the 100% income tax remission under the rules of the Jamaica Junior Stock Exchange, thus resulting in net profit of $60.15 million (2022: $56.31 million) for the three months ended March 31, 2023. The company noted, “The increase in our net position signals a realization of efficiency enhancements as well as a return to more predictable shopping tendencies of the Jamaican consumer base. As we continue to focus on providing exceptional customer service and delivering satisfaction, we believe that our trajectory for sustained growth is promising.”

Earnings per share (EPS) was $0.024 from $0.023 recorded for the quarter ended March 31, 2022. The twelve months trailing EPS was $0.12. The number of shares used in this calculation was 2,500,000,000 shares. MAILPAC last traded on May 11, 2023 at $1.92 with a corresponding P/E of 15.39x.

Balance Sheet at a glance:

As at March 31, 2023, total assets closed at $726.71 million, 17% less than $873.61 million documented twelve months earlier. Resulting mainly from a 39% increase in ‘Property, plant and equipment’ amounting to $139.90 million (2022: $100.29 million).

Shareholders’ equity totalled $637.74 million, 15% down from $750.86 million booked in 2022 resulting in a book value of $0.26 (2022: $0.30).

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may affect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.