February 9, 2022

Mailpac Group Limited (MAILPAC)’s revenue amounted to $1.82 billion for the twelve months ended December 31, 2021, 5% greater than $1.73 billion booked for 2020 year end. While, for the quarter, revenues closed at $501.73 million (2020: $512.14 million), 2% lower than the corresponding quarter due to a decline in “online shopping during 2020 driven by government-mandated limitations on physical movement,” as per MAILPAC.

Cost of sales totalled $926.38 million (2020: $906.72 million). As a result, gross profit amounted to $893.40 million (2020: $819.52 million), 9% higher than the previous comparable period due to cost rationalization in the first half of 2021. Gross profit for the fourth quarter amounted to $254.53 million (2020: $231.89 million).

Operating expenses for the period under review closed at $442.22 million (2020: $340.11 million), reflecting a 30% increase, Management noted, “this increase reflects the cost of our enhanced processing capacity, improved customer service capacity, additional delivery store locations, and amplified brand marketing. This is aligned with Mailpac’s stated commitment to invest in expanding its footprint as the e-commerce logistics provider of choice for Jamaican consumers.” The increases in operating expense was linked to;

- Selling and promotion totaled $69.03 million (2020: $53.89 million) rising 28% year over year.

- Administrative and general expenses closed at $373.19 million (2020: $286.22 million), up 30% year over year.

Operating expense for the quarter closed at $129.82 million, versus $110.18 million booked twelves earlier.

As such, operating profit for the twelve months period amounted to $451.19 million, a 6% decrease from the $479.41 million reported as of December 31, 2020. While for the quarter, operating profit closed at $124.71 million (2020: $121.71 million).

Mailpac recorded other income of $7.05 million (2020: $7.37 million), and a finance cost of $58.22 million (2020: $43.73 million) for the twelve months ended December 31, 2021.

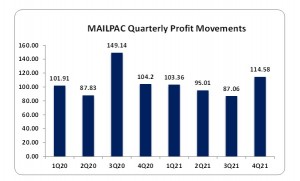

Consequently, Mailpac booked profit before taxation of $400.01 million (2020: $443.05 million), 10% down from the prior corresponding period. Profit before taxation for the fourth quarter closed at $114.58 million (2020: $104.17 million).

There was no taxation for the period under review, relative to a tax credit of $28,000 booked in 2020, as such net profit closed the FY2021 at $400.01 million, 10% down from the $443.08 million reported for 2020. While for the quarter, net profit totalled $114.58 million, 10% up from $103.84 million booked the corresponded quarter.

Consequently, earnings per share (EPS) amounted to $0.16 (2020: EPS of 0.18). For the quarter, EPS closed at $0.05 (2020: $0.04). The number of shares used in this calculation was 2,500,000,000 shares. MAILPAC traded on February 9, 2022 at $3.28 with a corresponding P/E of 20.37 times.

Management noted, “today, given the investments made throughout 2021, Mailpac is more focused and better equipped to meet its longterm goal of becoming a regional leader in e-commerce fulfillment. Through a mix of organic initiatives and acquisitions or investments, we expect Mailpac to efficiently capitalize on the inevitable long-term growth in the ecommerce sector within the Caribbean region.”

Balance Sheet at a Glance:

As at December 31, 2021, total assets closed at $820.58 million, 25% up from $654.39 million booked in December 2020. Notably, the increase in asset base is due to cash and cash equivalents amounting $366.36 million, 29% up from $283.99 million recorded in 2020. ‘Property, plant and equipment’ and ‘Right-of-use-assets’ also contributed to the growth by amounting to $96.61 million (2020: $57.70 million) and $47.66 million (2020: $13.53 million), respectively.

Shareholder’s equity totaled $696.73 million (2020: $571.36 million), resulting in a book value of $0.28 (2020: $0.23).

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein