December 1, 2020

Dr. Ian Blair, Independent Non-Executive Director – Main Event Entertainment Group, commented on the financial performance of the business for the year ended October 31, 2019. The company achieved revenue of $1.80 billion, a 29% increase over the $1.40 billion reported in 2018. Gross profit increased by 21% to $776.72 million compared to $640.12 million a year earlier. Net profit ended at $97 million, which represented a 3% increase over the $94.66 million reported the previous year.

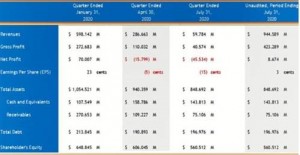

Financial Highlights 2019 – 2020:

- MEEG reported that the company delivered a record revenue of $598.14 million in the first quarter of 2020, which was the highest quarterly revenue earned by the company. This was accompanied by a gross profit of $272.68 million and a net profit of $70 million. Earnings per share for the period was $0.23.

- The results for the second quarter were affected by the onset of the global pandemic. Revenue fell to $286.66 million, gross profit ended at $110.03 million and the company reported a net loss of $15.80 million.

- In the third quarter revenue amounted to $59.78 million, gross profit totalled $40.57 million and the company reported a net loss of $45.53 million.

- The company saw limited trading activities in quarter three and reported that it earned year to date revenues of $944 million, down 31% relative to the corresponding period last year.

- The company has also realized year to date net profit of $8 million, a 92% reduction in comparison to the prior year.

- Year to date the MEEG reported shareholder’s equity of $560 million, an 11% decline following dividend payment and modest profits.

In explaining the company’s cash position versus its profitability; Dr Blair noted that “the company started out with a large capital expenditure in the last half of the financial year 2019 and the early parts of the 2020 financial year. The results of the capital expenditure were evident in our first quarter.” He added that, “depreciation charges of over $30 million were the reason behind the profit figures not being in line with the liquidity scenario of the company. This is because we had to write off a higher asset value than normal, in anticipation of the activities the company planned to perform in 2020.”

Some Covid-19 response measures according to Dr. Ian Blair, were outlined as follows:

- MEEG estimated how long the effects of the ‘Pandemic’ would last. After choosing a reasonable period, the company utilized the worst-case scenario and anticipated that it would be twice as long.

- The company decided to reduce planned capital expenditure in anticipation of a smaller footprint expected to last for several years.

- The company anticipated a lack of GOJ support due to the numerous other groups within the economy that would be ahead of the organization.

- The company considered the GOJ and MOH restrictions, health warnings, travel restrictions, and quarantines.

- Anticipated a significant reduction in consumer demand, especially for the products of their main corporate clients.

- Devised strategies to assist its corporate customers to navigate the difficult period.

- MEEG will continue to ensure that the company has the necessary liquidity to navigate through the difficult period.

MEEG’s cost-cutting strategies included:

- A reduction in workforce (especially sub-contractors).

- All team members had a reduction in their remuneration.

- Some team members opted for redundancy.

- MEEG received cost reductions from proprietors and provided reductions to it customers.

Outlook for Main Events, according to Management includes:

- Determine new skill requirements for any post-pandemic changes.

- Rationalization of the physical workplace i.e., reduce the real estate footprint.

- Maintain strong financial and cash management strategies to weather the ongoing pandemic.

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however, its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution, or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.