February 9, 2023

Main Event Entertainment Group Limited (MEEG)

For the year ended October 31, 2022:-

Main Event Entertainment Group Limited (MEEG) for the year ended October 31, 2022 recorded $1.55 billion in revenue compared to $758.39 million booked for the period ended October 31, 2021, a 104% increase year over year. Revenue for the quarter improved by 175% to close the quarter at $454.94 million relative to $165.66 million booked for the corresponding period in 2021. The Company noted, “The Company has generated revenues of $1,549 million in the current year compared to $758.393 million in 2021,which is an increase of 104%. Total revenues for the 2022 fiscal year have not reached to pre-pandemic levels, but the undeniably speedy and significant bounce back in the entertainment industry since its re-opening in March 2022 has been very motivating. 68% of the Company’s revenues were generated in the second half of the year; and revenues from entertainment and promotions have increased by 151% year over year to $1,044.851 million.”

Direct expenses for the year rose by 161% year over year to $794.18 million relative to the $304 million recorded in the prior corresponding period. Gross profit for the period grew by 66% to $754.82 million (2021: $454.39 million). Gross profit for the quarter increased 121% from $110.41 million in 2021 to $243.68 million in 2022. Speaking to gross margins, management stated, “Our gross margins have shown impressive improvements, climbing to 51% from 40% in the prior year. This $490.176 million (or 161%) growth in gross profits was driven by more favorable sales mix, success in cost containment measures and better capacity utilization. We have improved our monitoring and control of contracted costs and project overheads, and there are areas of continued cost savings from measures implemented during the pandemic.”

MEEG booked other income of $2.54 million for the twelve-month period, 16% higher than the prior year’s corresponding period of $2.19 million.

Total expenses rose by 37% to $578.75 million versus $423.73 million recorded for 2021. Of this, administrative and general expenses grew by 60% to $446.81 million (2021: $279.48 million), while depreciation expense decreased 10% to $109.73 million (2021: $121.99 million). Selling and promotion expense went up by 121% to $9.79 million relative to the $4.44 million booked last year. According to MEEG, “The general increases in operating expenses for this fiscal year largely reflects the return of more full-scale operations. Advertising and promotions, automobile related expenses, facility overheads, and staff costs accounted for the more significant increases. Expected credit losses (ECL) on trade receivables have also increased, by $10.212 million, which is a result of higher trade receivable activity and balances.”

Consequently, operating profit for the period rose 444% to $178.61 million (2021: $32.85 million). Operating profit for the quarter amounted to $51.17 million versus a profit of $11.15 million booked October 2021.

Finance cost year over year, contracted by 30% to $11.39 million (2021: $16.34 million) at the end of October 2022. Management attributes this decline in finance costs to a reduction in “debt exposure.”

MEEG recorded profit before taxation of $167.23 million relative to the $16.52 million reported for last year’s corresponding period. Likewise, profit before tax for the quarter grew significantly to close at $49.35 million relative to a profit of $7.49 million booked twelve months earlier.

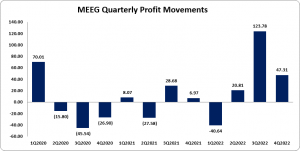

The company reported tax charge of $15.98 million (2021 tax credit: $377,000) during the period, resulting in net profit totaling $151.25 million, 837% higher than the $16.14 million reported a year prior. For the fourth quarter MEEG reported net profit of $47.31 million versus a profit of $6.97 million for the comparable period in 2021.

Earnings per Share (EPS) for the year ended amounted to $0.50 (2021: $0.05), while for the quarter the company booked an EPS of $0.16 relative to an EPS $0.02 in 2021. The trailing EPS amounted to $0.50. The number of shares used in the calculation was 300,005,000 units. Notably, MEEG stock price closed the trading period on February 8, 2023 at a price of $9.50 with a corresponding P/E ratio of 18.84 times.

Balance Sheet Highlights:

As at October 31, 2022, the company’s assets totalled $1.094 billion (2021: $791.26 million), $304.42 million more than its value one year ago. This growth in total assets was largely driven by a 271% increase in ‘Receivables’ which amounted to $355.74 million (2021: $95.85 million). ‘Deposit – short term’ also contributed to the upward movement adding $150.81 million to Total Assets. This ‘Deposit -short term’ line item represents an amount invested for greater than 90 days but less than 1 year at a rate of 5.75% per annum and includes accrued of $409,000.

Equity attributable to stockholders of the company amounted to $671 million (2021: $549.75 million). This translated to a book value per share of $2.24 relative to $1.83 for the corresponding period in 2021.

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may affect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.