April 9, 2021

Jamaica’s Net International Reserves (NIR) totalled US$3,319.33 million as at March 2021, reflecting an increase of US$303.15 million relative to the US$3,016.18 million reported at the end of February 2021 (see figure 1).

This change in the NIR resulted from a US$273.06 million increase in Foreign Assets which total US$4,243.53 million compared to the US$3,970.47 million reported for February 2021. ‘Currency & Deposits’ contributed the most to the increase in Foreign Assets. ‘Currency & Deposits’ as at March 2021 totalled US$3,681.36 million reflecting an increase of US$272.45 million compared to US$3,408.91 million booked as at February 2021.

‘Securities’ amounted to US$344.46 million; US$3.99 million more than the US$340.47 million reported at February 2021. While ‘SDR & IMF Reserve Position’ amounted to US$217.70 million; US$3.38 million less than the US$221.09 million reported at February 2021. Liabilities to the IMF accounted for 100% of total Foreign Liabilities; this amounted to US$924.20 million which reflected a month on month decrease of US$30.09 million in comparison to the US$954.29 million recorded for February 2021.

At its current value, the NIR is US$81.66 million more than its total of US$3,237.67 million reported at the end of March 2020. The current reserve is able to support approximately 53.65 weeks of goods imports and 38.71 weeks of goods and services imports.

Figure 1

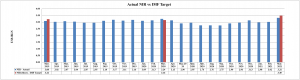

Figure 2

The country came in above the benchmark of US$3.16 billion outlined by the International Monetary Fund for March 2020, closing the fiscal year at US$3.24 billion, US$0.09 million above targeted amount. The Net International Reserve (NIR) target outlined as per the new agreement for the 2020/21 fiscal year is US$3.49 billion (see figure 2 above). As at March 2021, the Country ended US$0.17 million below the targeted amount.

Speaking during the BOJ’s digital quarterly briefing on February 19, 2021, Bank of Jamaica (BOJ) Governor Mr. Byles said that notwithstanding the fallout in tourism earnings due to a dramatic decline in visitor arrivals consequent on COVID-19, coupled with lower imports, inflows to the foreign exchange market have remained healthy. He noted, “Jamaica’s net international reserves (NIR), totalling just under US$3 billion as at February 16, should be “quite adequate” to see the country through the coronavirus (COVID-19) pandemic crisis.” Furthermore, “ We also saw a dramatic improvement in remittance inflows, which served to cushion the effects of the fallout in tourism on our balance of payments. Private capital outflows were also tempered by a reduction in capital market foreign exchange investments”

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.