Date: October 10, 2019

Net International Reserves- September 2019

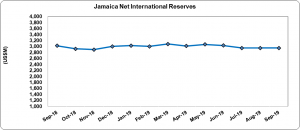

Jamaica’s Net International Reserves (NIR) totaled US$3,098.05 million as at September 2019, reflecting an increase of US$161.60 million relative to the US$2,936.45 million reported as at the end of August 2019 (see figure 1).

Changes in the NIR resulted from an increase in Foreign Assets of US$151.35 million to total US$3,581.92 million compared to the US$3,430.57 million reported for August 2019. ‘Currency & Deposits’ contributed the most to the increase in Foreign Assets. ‘Currency & Deposits’ as at September 2019 totaled US$3,041.30 million reflecting an increase of US$162.51 million compared to US$2,878.79 million booked as at August 2019.

‘Securities’ amounted to US$311.06 million; US$10.31 million less the US$321.38 million reported in August 2019. Foreign Liabilities for September 2019 amounted to US$483.86 million compared to the US$494.12 million reported for August 2019. Liabilities to the IMF accounted for 100% of total foreign liabilities, reflecting a US$10.25 million decrease month over month from August 2019.

At its current value, the NIR is US$71.33 million more than its total of US$3,026.72 million as at the end of September 2018. The current reserve is able to support approximately 33.45 weeks of goods imports or 22.82 weeks of goods and services imports.

Figure 1

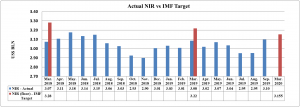

Figure 2

The country came in slightly below the benchmark of US$3.22 billion outlined by the International Monetary Fund for March 2019, closing the fiscal year at US$3.08 billion, US$0.13 million below targeted amount.

An International Monetary Fund (IMF) staff team led by Uma Ramakrishnan visited Jamaica from June 10 to 14, 2019, ahead of the sixth and final review under the SBA planned for September 2019. The team took stock of progress on Jamaica’s economic reform program supported by the IMF’s precautionary Stand-By Arrangement (SBA).

Following the meeting, the IMF issued a statement citing, “Jamaica’s improved economic growth in FY2018/19 was buoyed by construction and mining. Unemployment is now at an all-time low of 8 percent. The inflation outturn was 3.9 percent (y/y) in April, closer to the Bank of Jamaica’s (BOJ) target range of 4–6 percent. The primary surplus was almost 7½ percent of GDP in FY2018/19, with public debt falling to about 95 percent of GDP at end-March 2019—the lowest since FY2000/01. Non-borrowed reserves were US$430 million above target at end-March 2019, providing critical buffer against unforeseen global economic shocks.”

The Net International Reserve (NIR) target outlined as per the new agreement for the 2019/20 fiscal year is US$3.155 billion (see figure 2 above). As at September 2019, the Country is US$0.06 million below targeted amount.

Analyst Certification -This research report is for information purposes only and should not be construed as a recommendation. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.