June 6, 2022

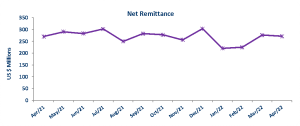

Total remittance inflow as at April 2022 amounted US$288.9 million, a 0.1% decrease from the US$289 million booked twelve months earlier. The decrease in total remittance inflow was due largely to a 0.9% decrease in ‘Remittance Companies’ to US$252.8 million (2021: US$254.9 million), however it was offset by a 6% increase in ‘Other Remittances’ to US$36.1 million (2021: US$34 million). As travel returns, the small reduction in remittance inflows is partially due to decreasing cash in hand remittances. Increased living costs in the key source markets also played a role. Total Remittance Outflows decreased 5.8% or US$1.1 million to US$17.3 million ( 2021: US$18.3 million). As a result, Jamaica’s net remittances as at April 2022 amounted to US$271.6 million, 0.3% or US$0.9 million higher than the US$270.7 million recorded April 2021.

According to the Bank of Jamaica (BOJ), during the period under review USA was the largest source of remittance flow to Jamaica, accounting for 71% of total remittance inflow, down from 72.3% recorded in April 2021. While Canada contributed 9.9%, UK 9.7% and Cayman Islands 5.9%.

Additionally, for the Calendar year to April 2022, net remittance totalled US$993.6 million, a 1.9% decrease relative to the US$1.01 billion for the comparative period last year. It was noted that, the decrease was as a result of a 1% or US$11.2 million decline in total remittance inflows. This was partly offset by an increase of 9.7% or US$7.8 million in total remittance outflows. The decrease in total remittance inflow was driven by a decrease in ‘Remittance Companies’ by 2.5% while ‘Other Remittances’ increased by 9.3%.

In comparison with other countries, for the period January-April 2022, Jamaica’s remittance inflows decreased by 1% to total US$1.08 billion. Jamaica 1% decline in remittance is lower than Guatemala 24.9% and El Savaldor 4% growth.

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may affect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.