November 15, 2024

Pan Jamaica Group Limited (PJAM) for the nine months ended September 30, 2024, reported a 51% increase in Gross operating revenue totaling $29.19 billion compared to $19.37 billion in the corresponding period last year. Gross operating revenue for the third quarter had a 5% increase to close at $9.85 billion compared to $9.40 billion for the comparable quarter of 2023.

Cost of operating revenue amounted to $20.73 billion (2023: $13.38 billion), this represents an increase of 55% year over year. Consequently, gross profit increased by 41% to $8.46 billion compared to $5.99 billion for the nine months ended September 30, 2023. The company booked gross profit of $2.81 billion for the third quarter versus $2.94 billion reported for the similar quarter of 2023.

Other income increased by 96% to close at $648.87 million (2023: $330.80 million).

Net Investment income increase by 6% from $606.72 million in 2023 to $644.71 million in the period under review.

Selling, administration and other operating expenses for the nine months ended September 30, 2024 amounted to $6.52 billion, a 34% increase relative to $4.87 billion reported in 2023.

Share of profits in associates and joint ventures for the nine months ended September 30, 2024, amounted to $2.13 billion, a 25% decrease relative to $2.83 billion reported in 2023.

Consequently, Profit before finance cost and taxation totalled $5.36 billion a 10% increase from the corresponding period last year. (2023: $4.89 billion). For the third quarter, Profit before finance cost and taxation amounted to $1.76 billion (2023: $2.23 billion).

Finance costs totalled $1.12 billion a 16% increase from the corresponding period last year (2023: $963.72 million).

Profit before taxation for the first nine months ended September 30, 2024, amounted to $4.24 billion, an 8% increase relative to $3.93 billion reported in 2023.

Following the 9% decrease in Taxation for the nine months to $470.05 million (2023: $518.91 million), Net profit amounted to $3.77 billion from the $3.41 billion reported in 2023.

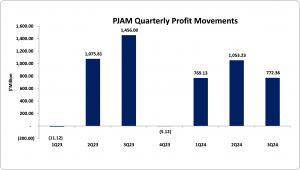

Net profit attributable to shareholders for the nine months ended September 30, 2024, amounted to $2.59 billion, a 3% increase relative to $2.52 billion reported in 2023. For the third quarter, Net profit attributable to shareholders was $772.36 million (2023: $1.46 billion).

Earnings per share for the nine months amounted to $1.59 (2023: EPS: 1.55), while Earnings per share for the quarter totaled $0.47 (2023: $0.89). The twelve-month trailing EPS was $1.59, and the number of shares used in these calculations was 1,627,725,023.

Notably, PJAM’s stock price closed the trading period at $46.58 on November 15, 2024, with a corresponding P/E ratio of 29.28x

Balance Sheet Highlights:

The company’s assets totalled $143.93 billion (2023: $130.44 billion). The growth in total assets was mainly due to a $6.97 billion uptick in “PPE”, a $5.80 billion increase in “Investments in associates and joint venture” and “Cash balances” growing by $4.69 billion during the period.

Shareholder’s equity was $78.57 billion (2023: $74.32 billion), representing a book value per share of $48.27 (2023: $45.66).

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.