November 5, 2020

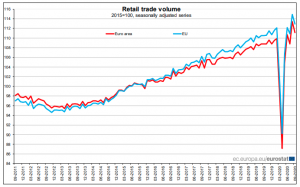

According to Eurostat, the Statistical Office of the European Union, the seasonally adjusted volume of retail trade in September 2020 declined by 2.0% in the euro area and by 1.7% in the EU when compared with August 2020. Whereas, in August 2020 the retail trade volume increased by 4.2% in the euro area and by 3.6% in the EU.

However, in comparison to September 2019, September 2020’s calendar adjusted retail sales index rose by 2.2% in the euro area and by 2.1% in EU.

Monthly comparison by retail sector and by Member State

In comparison to August 2020, the volume of retail trade fell in the euro area in September 2020 by 0.2% for automotive fuels, by 2.6% for non-food products, and by 1.4% for food, drinks, and tobacco. In the EU, “the volume of retail trade decreased by 2.1% for non-food products, by 1.1% for food, drinks and tobacco and by 0.5% for automotive fuels,” as indicated by the Eurostat.

Furthermore, Eurostat noted, “the largest decreases were observed in Belgium (-7.4%), France (-4.5%) and Germany (-2.2%). The highest increases in the total retail trade volume were registered in Bulgaria (+2.8%), Portugal (+1.9%) and Romania (+1.7%).”

Annual comparison by retail sector and by Member State

In September 2020, compared with September 2019, the volume of retail trade rose by 2.9% for food, drinks and tobacco and by 2.6% for non-food products, while automotive fuel decreased by 3.8% in the euro area. While in the EU, the retail trade volume rose by 2.9% for non-food products and by 2.4% for food, drinks and tobacco; however, automotive fuel decreased by 4.6%.

Eurostat highlighted that, “Among Member States for which data are available, the highest yearly increases in the total retail trade volume were registered in Ireland (+11.5%), Lithuania (+6.2%), Latvia and Slovakia (both +5.9%). The largest decreases were observed in Malta (-12.2%), Slovenia (-6.9%) and Bulgaria (-6.7%).”

Disclaimer:

Analyst Certification –The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure –The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.