July 15, 2020

Radio Jamaica Limited (RJR), for the year ended March 31, 2020, reported revenues of $5.59 billion versus $5.48 billion in 2019, increasing by 2% year over year. For the quarter, revenues closed at $1.25 billion (2019: $1.28 billion). Management noted that, “revenue increased in all segments, Audio 6%; Audio/Visual 1% and Print 1%.”

Direct expenses decreased to $2.59 billion, this compares to the prior year’s figure of $2.74 billion, indicating a decline of 6%. For the quarter, direct expenses fell by 4% amounting to $570.36 million (2019: $595.03 million). The Company stated that, “this was due mainly to the FIFA World Cup and related costs in prior year which did not apply in the year under review.”

As such, gross profit for the year end closed at $3.01 billion relative to $2.74 billion for the corresponding period in 2019. While for the quarter, gross profit totalled $681.47 million (2019: $680.85 million).

Total expenses increased by 6% for the period under review from $2.84 billion in 2019 to $3.01 billion in 2020.

There was a 5% increase in selling expenses to $853.08 million (2019: $811.08 million). RJR noted that, “this commensurate with revenue increases.”

Administrative expenses closed at $1.25 billion (2019: $1.26 billion). Management highlighted that, “this was as a result of reduction in amortization cost for intangible assets.”

Other operating expenses amounted to $915.94 million versus $765.33 million reported in the previous comparable period. Management stated that this increase was, “due to costs related to new business feasibility study, and fees associated with the acquisition of new software across the group.”

Other income dropped to total $98.31 million compared to the 2019 figure of $126.75 million. While, for the quarter, other income closed at $14.04 million (2019: $37.77 million). RJR noted that this movement was, “mainly driven by one off nonrecurring income in the prior year.”

Operating profit widened by 184% for the period in review, from $31.83 million in 2019 to $90.45 million in 2020. As for the quarter, there was an operating loss of $125.50 million in 2020 relative to an operating loss of $59.99 million in the prior corresponding period.

Finance costs decreased by 9% year over year to $50.83 million versus $56.08 million in the prior year. While for the quarter, finance cost amounted to $6.63 million (2019: $9.93 million).

Share of net loss of associates stood at $148,000 (2019: nil), followed by a profit before tax of $39.47 million relative to a loss of $24.25 million booked at the end of 2019.

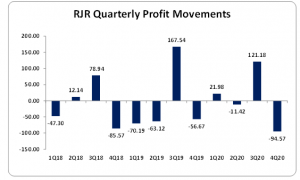

Taxation charge was $1.91 million reported in 2020 compared to tax credit of $1.81 million in 2019, RJR recorded net profit of $37.56 million versus net loss of $22.44 million booked in 2019. For the quarter, net loss amounted to $96.84 million (2019: $56.67 million).

Total comprehensive loss closed the period under review at $7.17 million compared to total comprehensive income of $28.83 million in the same period last year.

The earnings per share (EPS) for the year end amounted to $0.02 versus 2019 same period loss per share of $0.01. For the quarter, LPS of $0.039 was recorded versus an LPS of $0.023. The number of shares used in this calculation was 2,422,487,654 units. RJR stock last traded on July 15, 2020 at $1.31.

Management also noted that, “in spite of the Group’s robust performance for the eleven (11) months of the year, the impact of COVID-19, locally and internationally, dramatically and negatively impacted business revenues in the month of March 2020. For March alone, the Group incurred almost $50 million in advertising contract cancellations, while staff welfare, sanitization and related expenses increased due to measures implemented to safeguard staff and customers.”

RJR mentioned that, “During the financial year under review the Group continued implementation of its roadmap towards full digital transformation, which adds conversion of business process functions to the already underway broadcast workflow transition pending digital switchover. TVJ brought in new revenue streams from the Cayman Islands through the launch of the TVJ International channel, while locally, TVJ started earning re-transmission fees from the largest cable provider, FLOW. The radio and television Transmission networks were improved across the island, with further improvements slated for the new financial year, while the Group maintained its strong brand equity through continued unique product differentiation in quality local programming and relevant content.”

Balance Sheet Highlights:

RJR, as at March 31, 2020, recorded ‘Total Assets’ of $3.77 billion, a rise of 1% when compared to $3.72 billion for the previous corresponding period. This was attributable to increases in “Investments accounted for using the equity method”, “Receivables”, and “Fixed assets” which closed at $70.43 million (2019: nil), $1.02 billion (2019: $914.31 million) and $1.55 billion (2019: $1.50 billion), respectively. These increases were, however, tempered by a 37% decrease in ‘Cash and Bank Balances” which amounted to $281.82 million (2019: $446.43 million).

Total Shareholders’ Equity closed at $2.30 billion, down 2% from $2.35 billion last year. This resulted in a book value of $0.95 (2019: $0.97).

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.