November 12, 2021

IronRock Insurance Company Limited (ROC), for the nine months ended September 30, 2021 posted gross premium of $620.54 million relative $603.21 million; this represents a 3% increase year over year. For the third quarter gross premium rose by 16% to total $209.40 million compared to $181.23 million in 2020.

Proportional reinsurance amounted to $452.45 million compared to $445.64 million in 2020, while excess of loss reinsurance closed the period at $40.34 million (2020: $33.33 million), 21% up from the prior year’s corresponding period.

As a result, net premium revenue amounted to $127.24 million relative to $124.24 million in 2020, a 3% increase. While for the quarter, net premium revenue increased by 32% to close at $45.13 million (2020: $34.29 million).

Net earned premium, for the nine months ended September 30, 2021, amounted to $142.21 million (2020: $144.64 million) with net unearned premium adjustment of $14.46 million (2020: $20.40 million). During the quarter, net earned premium amounted to $48.70 million (2020: $46.80 million), after unearned premium adjustment of $3.58 million (2020: $12.51 million) was added.

Commission incurred totalled $75.53 million in contrast to $67.75 million in 2020, while commission earned grew by 18% from $74.86 million in 2020 to total $88.56 million for the period under review.

Net claims declined by 11% from $78.62 million in 2020 to $70.10 million for the nine months ended September 30, 2021. In addition, operating expenses went up by 5% to $144.32 million (2020: $137.19 million). As such, underwriting loss for the period amounted to $59.18 million relative to a loss of $64.07 million a year earlier. Underwriting loss for the quarter amounted to $27.94 million compared to the underwriting loss of $18.66 million reported in 2020.

ROC recorded $50.33 million for total other income, relative to $51.03 million booked for the nine months ended September 2020. Of this:

- Investment income amounted to $31.78 million relative to $30.86 million in September 2020.

- Foreign exchange gain amounted to $15.60 million versus $11.91 million in September 2020.

- Gain on sale of investment amounted to $2.95 million versus $8.11 million in September 2020.

- Bank interest amounted to $11,000 versus $156,000 booked September 2020.

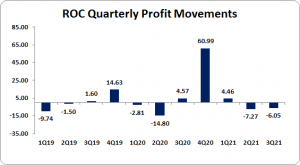

As a result, the Company recorded a loss before taxes of $8.85 million compared to a loss of $13.04 million the prior period, while loss before tax for the quarter totalled $6.05 million relative to a profit of $4.57 million for the comparable quarter in 2020. Since there was no tax recorded for the period, net loss amounted to $8.85 million (2020: net loss of $13.04 million). For the quarter, net loss closed at $6.05 million compared to loss of $4.57 million in the same period last year.

Loss per share accumulated to $0.04 (2020 LPS: $0.06), while for the quarter, LPS amounted to $0.028 (2020 EPS: $0.02). The trailing twelve months loss per share amounted to $0.24. The stock price as at November 12, 2021 was $3.49 with a corresponding P/E of 14.32 times. The numbers of shares used in the calculations are 214,000,000.00 units.

Management noted, “The third quarter saw continued price competition in the property and motor markets, however by the end of the quarter the market began showing signs that pricing was beginning to stabilize. Despite the soft market conditions, we acquired a number of new corporate accounts at risk adjusted pricing levels well above market levels and we maintained growth in our retail direct client portfolio.”

Furthermore, ROC also stated that, “Earlier in the year we introduced Motor products targeted at, and with coverage and rating tailored to, specific market segments, with the added bonus of the introduction of a range of installment plans for premium payment. The take up has been excellent and we are particularly pleased that the majority of the engagement by our clients has taken place through our digital platforms, on the web and through our mobile application. Additionally, the upgrade of our eCommerce payment portal now allows clients to set up periodic recurring payments which has made it easier for our clients to manage their payment plans and improved our internal efficiency significantly. Based on participation rates, that have exceeded our projections, it is obvious that these innovations have been welcomed by our direct clients and auger well for increased growth in that portfolio.”

Management highlighted that, “the accident frequency and loss ratios of these products are significantly lower than those of our standard Motor policies, thus confirming that our risk assessment strategy is correct and offering us opportunities for profitable growth in the future. During the quarter we began investing in a strategic overhaul of the Company’s IT infrastructure aimed at improving efficiencies of our internal processes, allow for a more robust response to disaster events and complement our transition to a fluid Work From Home protocol. These and other changes will also put us in good stead for the introduction of planned technology roll-outs which will allow for new and more customer centric ways of delivering service to our valued clients.”

Balance Sheet Highlights:

As at September 30, 2021, ROC’s assets totalled $1.44 billion (2020: $1.36 billion), 6% greater than the amount booked during 2020. ‘Investment’ contributed to the increase in the asset base closing the period at $710.37 million (2020: $492.27 million). The movement was offset by ‘Securities purchased under resale’ which declined to nil from $171.33 million in 2020.

Shareholder’s equity closed at $558.87 million (2020: $495.34 million) which resulted in a book value per share of $2.61 (2020: $2.31).

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.