August 13, 2020

IronRock Insurance Company Limited (ROC), for the six months ended June 30, 2020 posted gross premium of $421.98 million relative $318.55 million; this represents a 32% increase year over year. For the second quarter gross premium rose by 23% to total $243.31 million compared to $197.77 million.

Proportional reinsurance amounted to $309.91 million compared to $187.28 million in 2019, while excess of loss reinsurance closed the period at $22.13 million (2019: $23.74 million), 7% down from the prior year’s corresponding period.

As a result, net premium revenue amounted to $89.95 million relative to $107.53 million in 2019, a 16% decrease while for the quarter, net premium revenue went down by 34% to close at $38.08 million (2019: $57.68 million).

Net insurance premium revenue amounted to $97.83 million (2019: $101.35 million) with net earned premium adjustment of $7.89 million versus a net unearned premium adjustment of $6.18 million in 2019. During the quarter net insurance premium amounted to $47.04 million (2019: $53.63 million), after earned premium adjustment of $8.96 million (2019: $4.05 million unearned) was added.

Commission expense totalled $43.96 million in contrast to $33.50 million in 2019, while commission income grew by 49% from $30.77 million in 2019 to total $45.89 million.

Net claims declined by 15% from $59.68 million to $50.88 million for the six months ended June 30, 2020. In addition, operating expenses went up by 23% to $94.30 million (2019: $76.62 million). As such, underwriting loss for the period amounted to $45.41 million relative to a loss of $37.68 million a year earlier. Underwriting loss for the quarter amounted to $22.35 million compared to the $20.19 million reported in 2019.

ROC recorded $27.80 million for total other income, relative to $26.45 million booked for the six months ended June 2019. Of this;

- Investment income amounted to $21.26 million relative to $18.01 million in June 2019.

- Foreign exchange gain amounted to $4.99 million versus $2.84 million in June 2019.

- Gain on sale of investment amounted to $1.52 million versus $5.58 million in June 2019

- Bank interest amounted to $29,000 versus 16,000 booked June 2019.

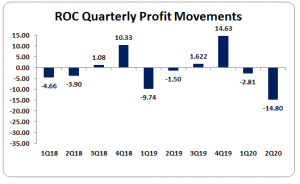

As a result, the company recorded a loss before taxes of $17.61 million compared to a loss of $11.24 million the prior period, while loss for the quarter totalled $14.80 million relative to the loss of $1.5 million for the comparable quarter in 2019. Since there was no tax recorded for the period, net loss equals pre-tax loss for both the quarter and six months period.

Loss per share accumulated to $0.08 (2019 LPS: $0.05), while for the quarter, LPS amounted to $0.069 (2019 LPS: $0.007). The trailing twelve months loss per share amounted to $0.0063. The stock price as at August 13, 2020 was $3.40. The numbers of shares used in the calculations are 214,000,000.00 units.

Management noted, “During the financial quarter ended 30 June 2020, our operations continued to be affected by the impact of the COVID-19 pandemic on the economic and social fabric of our society. The most noticeable adverse effect has been on our revenue growth rate, which has tapered off from the strong momentum built in the first quarter.”

Furthermore, “There have been some positive impacts, mainly brought on by changes in the way we do business. Client engagement through our digital platforms has grown significantly, and we expect this effect to persist. Going forward, this should help us efficiently grow our direct client portfolio. Additionally, the Work From Home (“WFH”) model that we implemented during the government mandated lock-downs proved to be so effective, that we have now incorporated WFH into our normal operations.” Management stated.

Balance Sheet Highlights:

As at June 30, 2020, ROC’s assets totalled $1.47 billion (2019: $1.11 billion), 33% greater than the amount booked during 2019. ‘Reinsurance Assets’ and ‘Insurance and other Receivables’ contributed to the increase in the asset base closing the period at $367.17 million (2019: $198.61 million) and $296.04 million (2019: $163.33 million), respectively. In addition, the company reported ‘Securities purchased under resale’ which closed at $112.72 million (2019: nil) at the end of the six months.

Shareholder’s equity closed at $495.84 million (2019: $536.64 million) which resulted in a book value per share of $2.32 (2019: $2.51).

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein