Date: August 09, 2018

Salada Foods, for the nine months ended June 30, 2018, recorded a 22% increase in turnover for the nine months to close at $748.70 million (2017: $612.80 million). For the third quarter revenue amounted to $266.43 million (2017: $208.42 million), a 28% rise. The company highlighted that, “Domestic sales through our distributor continue to perform well representing a net increase of $51.38 million or 11.8% higher in comparison to the same period prior year. The introduction of the Mountain Bliss 876 brand has bolstered domestic sales, achieving a 45% distribution into the retail market since launch in May of 2018.”

SALF also noted that, “Exports grew by $40.48 million or 62.9% as sales into North America increase. There has been steady improvement in the New York market. Sales into Canada has also increased more than 100%. Sales of products manufactured under contract grew 48.6% or $43.67 million more than the comparative period of the previous year.”

Cost of sales for the nine months increased by 15% to close the period at $455.91 million relative to $397.72 million in 2017. As such, gross profit amounted to $292.80 million, a 36% increase year over year from the $215.08 million booked in the prior year. Gross profit for the third quarter posted a 44% growth to close at $101.57 million relative to $70.62 million booked for the comparable quarter in 2017.

Other operating income for the first nine months amounted to $2.77 million relative to loss of $1.80 booked in 2017.

Administrative expenses fell by 5% to $89.56 million (2017: $94.04 million). Also, selling and promotional expense fell by 5% from $43.46 million in 2017 to $41.11 million. Management stated that, “This was due to a shift in marketing strategy utilizing social media instead of traditional media sources as we continue to engage a younger audience.”

Consequently, this resulted in an operating profit of $164.90 million, up 118% compared with the $75.78 million reported for the corresponding nine months for prior year. Operating profit for the third quarter recorded a 162% improvement to $57.52 million (2017: $21.99 million).

The company reported net finance income of $15.96 million for the period; this compares to the net finance income of $10.73 million for the same period in 2017.

Profit before taxation increased by 109% to $180.85 million versus $86.51 million booked for the previous year’s corresponding period.

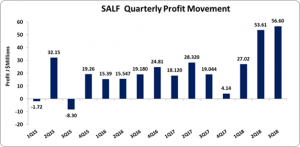

For the nine months ended June 30, 2018 net profit climbed significantly by 116%, from $63.29 million in 2017 to $136.85 million following taxation of $44 million (2017: $23.22 million). Net profit for the quarter rose by 208% to $56.58 million in 2018 relative to $18.38 million in 2017.

Net profit attributable to shareholders for the nine months amounted to $137.22 million relative to $65.49 million twelve months earlier. Profit attributable to shareholders for the quarter amounted to $56.60 million compared to $19.04 million for the corresponding quarter of 2017.

Earnings per stock unit for the nine months amounted to $1.32 (2017: $0.63). the EPS for the third quarter was $0.54 (2017: $0.18). The trailing twelve-month EPS is $1.36. SALF stock price closed the trading period on August 09, 2018 at a price of $15.00.

The company noted, “At the end of this nine-month reporting period all the business indicators were aligned in the right direction with company set on an upward trajectory. This position however, will be adversely affected should the Government’s recently imposed cess on imported green beans in addition to the 20% local blending rule remain in effect.”

Balance Sheet at a Glance:

As at June 30,2018, total assets rose by 16% or $150.31 million to $1.11 billion. This increase was primarily driven by accounts receivables and investments which amounted to $220.74 million (2017: $140.24 million) and $253.28 million (2017: $116.48 million) respectively. Accounts receivables grew 57% for the first nine months when compared to the previous corresponding, while investments recorded a 117% growth over the same period.

Shareholders equity as at June 30,2018, amounted to $835.41 million (2017: $787.32 million) resulting in a book value per share of $8.04 (2017: $7.58).

Disclaimer:

Analyst Certification -This research report is for information purposes only and should not be construed as a recommendation. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may affect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.