November 5, 2019

Sagicor Group Jamaica (SJ), for the nine months ended September 30, 2019 reported a 31% increase total revenues to $67.51 billion from $51.48 billion in 2018, while for the third quarter total revenues were up 28% to total $24.92 billion compared to $19.46 billion in 2018. Total revenue for the nine months was broken down as follows:

- Net premium revenue increased by 18% to a total of $33.79 billion compared to $28.75 billion last year.

- Net investment income rose to $19.33 billion from $13.62 billion in 2018, a 42% increase.

- Fees and other revenue increased 16% to $10.51 billion from $9.10 billion in 2018.

- Hotel Revenue stood at $3.87 billion for the period under review.

SJ noted, “the current year-to-date results benefited mainly from overall good new business and portfolio growth which were both better than prior year.”The company also stated, “Other factors positively influencing the outcome for the period include the depreciation of the J$ to the US$ of 6% which gave rise to realized and unrealized gains attributable to US$ positions; the 36% appreciation of the Jamaica Stock Exchange main index with the Group earning trading gains and capital appreciation.”

Benefits and expenses totalled $53.66 billion for the period, a rise of 35% from $39.87 billion, while for the third quarter benefits and expenses were up 37% to close at $19.46 billion relative to $14.24 billion in 2018. Of this:

- Commission and related expenses grew by 11% to $4.24 billion from $3.83 billion.

- Administration expenses increased by 16% to $15.29 billion (2018: $13.22 billion).

- Changes in insurance and annuity liabilities moved from $2.70 billion in 2018 to $8.60 billion for the nine months ended September 30, 2019.

- Net insurance benefits incurred amounted to $21.18 billion versus $18.98 billion that was recorded last year.

- Other taxes and levies totalled $641.76 million, a 1% increase relative to $637.92 million.

- Amortization of intangible assets rose 7% from $521.08 million to $556.27 million.

- Hotel Expenses totalled $3.16 billion for the period under review

Furthermore, Management highlighted that “administration expenses were higher than prior year by 16%, of which over half is due to consolidation of subsidiaries added in Q4 2018, reflecting increments to Team Members’ compensation expenses and higher Payments channels related costs in Sagicor Bank. The Group efficiency ratio of administration expenses to total revenue, a key measure of expense management, was unchanged year on year at 31%.”

Share of loss from joint venture amounted to $8.63 million relative to a share of profit of $42.60 million a year earlier. Share of profit from associate for the period totalled $680.05 million compared to a loss of $170.53 million last year.

As such, Profit before Taxation amounted to $14.52 billion, a 27% increase when compared to the $11.48 billion booked in 2018.

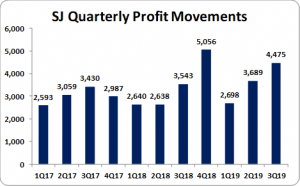

Investment and corporation taxes of $3.22 billion was reported for the period (2018: $2.65 billion), as such net profit for the nine months totalled $11.30 billion (2018: $8.82 billion), a 28% climb. Profit for the quarter amounted to $4.17 billion relative to $3.54 billion in 2018, up 18% year over year.

Net profit attributable to shareholders for the period amounted to $10.86 billion relative to $8.82 billion the prior year’s period. For the quarter, net profit attributable to shareholders increased 26% to $4.47 billion (2017: $3.54 billion).

Earnings per share for the quarter amounted to $1.146 (2018: $0.907), while EPS for the period totalled $2.781 relative $2.259 in 2018. The twelve month trailing EPS amounted to $4.17. The total number of shares used in the calculations amounted to 3,905,634,918 units. SJ’s stock last traded on November 5, 2019 at $63.98.

In addition, SJ highlighted, “We remain optimistic about the future and prospects for the rest of 2019. The Jamaican economy continues to perform well in an environment of low unemployment, low interest rates, moderate inflation although the rate of GDP growth remains a concern. We continue to diligently push our strategies for growth while improving our efficiencies, all in order to improve our Clients’ experience of doing business with Sagicor and to earn attractive returns for our Stakeholders.”

Balance Sheet at a glance:

Total Assets increased by 23% or $84.82 billion to close at $457.93 billion as at September 30, 2019 from $373.12 billion the year prior. The movement was attributed to a $21.62 billion increase in ‘Financial investments’ , a $19.51 billion increase in ‘Investment in associated company’ and $16.50 billion increase in ‘Property, plant and equipment’ which closed at $195.84 billion (2018: $174.23 billion), $26.66 billion (2018:$ 7.15 billion) and $21.55 billion (2018:$5.05 billion) respectively. However, this was offset by 17% decline in ‘Cash Resource’ ending the period at $24.52 billion ( 2018: $29.39 billion).

Equity attributable to stockholders of the company as at September 30, 2019 stood at $88.38 billion (2018: $73.39 billion) resulting in book value per share of $22.63 (2018: $18.79).

Analyst Certification -This research report is for information purposes only and should not be construed as a recommendation. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.