August 11, 2022

SOS reported six months revenue of $847.70 million relative to $550.87 million reported in 2021, a 54% increase year over year. While for the second quarter revenues amounted to $420.08 million up 77% compared to the $237.56 million reported in the corresponding quarter of 2021.

The Company’s cost of sales totalled $416.21 million up 60% relative to the $260.75 million reported in 2021. Nevertheless, gross profit rose by 49% for the six months amounting to $431.49 million relative to the $290.12 million booked in 2021, while gross profit for the quarter totalled $213.69 million (2021: $120.51 million).

Administrative expenses totalled $202.17 million up 24% compared to the $162.91 million booked in 2021, while selling and promotion expenses grew by 41% closing the period at $60.56 million relative to the $43.04 million reported in 2021. For the quarter, administrative expenses went up by 28% to $104.98 million (2021: $82.32 million), while selling and promotion expenses closed at $31.85 million (2021: $21.97 million), a 45% increase year over year.

The Company’s depreciation cost for the six months ended June 30, 2022, amounted to $17.70 million, an 8% uptick relative to the $16.46 million incurred in 2021, while finance cost closed at $4.55 million (2021: $6 million).

Loss on foreign exchange amounted to $64,490 (2021: $3.87 million). Profit on disposal of property plant and equipment amounted to $26.95 million (2021: nil). Notably, no gain on investment was reported.

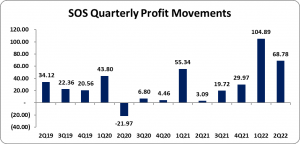

There was no taxation booked for the six months ended June 30, 2022. As such, net profit rose by 197% amounting to $173.67 million relative to the $58.43 million earned in 2021. For the quarter, there was a net profit of $68.78 million relative to a net profit of $3.09 million in 2021. SOS stated that, “After a record-breaking 1st Quarter in 2022, SOS was able to follow this up in the 2nd Quarter with its second-best quarter in the 57-year history of the company. During the 2nd Quarter we completed the delivery and installation of a new 200 plus seat call centre as well as other projects. The scope of work that was completed during this quarter included industrial racking projects, mobile filing systems, and several new office installations. The majority of these projects were supplied and installed from our everyday inventory, which is important, as shipping timelines for products being delivered to Jamaica are still very unreliable, taking up to as long as 24 weeks to arrive.”

Earnings per share for the period amounted to $0.69 (2021 EPS: $0.23), while EPS for the quarter totalled $0.27 (2021: 0.01). The twelve-month trailing EPS amounted to $0.89. As at August 11, 2022, the stock traded at $16.59 with a corresponding P/E ratio of 18.66 times.

Balance Sheet Highlights:

Total Assets rose by 4% to close at $1.09 billion as at June 30, 2022 from $920.77 million the year prior. The growth stemmed from 213% growth in ‘Prepayments’ to $119.28 million (2021: $38.14 million). ‘Trade and other receivables’ also contributed to the increase to close at $163.81 million relative to the $102.04 million recorded twelve months earlier.

Equity attributable to stockholders of the company as at June 30, 2022 stood at $850.50 million (2021: $668.16 million). This resulted in a book value per share of $3.40 (2021: $2.67).

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may affect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.