May 12, 2023

Stationery & Office Supplies Limited (SOS) for the three months ended March 31, 2023:

Revenue increased 21% to $519.18 million (2022: $427.62 million). Notably, this represents the Company’s highest quarterly revenue.

Gross profit increased 24% to $270.47 million (2022: $217.81 million).

Total operating expenses increased 18% to $158.78 million (2022: $134.18 million). The largest contributor to the increase was administrative and general expenses, which increased 19% to $115.37 million (2022: $97.19 million). Management noted that salary increase was given to staff in February.

Operating profit increased 32% to $111.40 million (2022: $84.17 million).

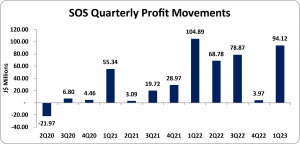

Net profit declined 10% to $94.12 million (2022: $104.89 million) following taxation charge of $14 million.

Earnings per share (EPS) amounted to $0.38 (2022: $0.42). The trailing twelve-month EPS amounted to $0.98. The number of shares used in the calculations is 250,120,500. SOS’s stock price closed the trading period on May 11, 2023 at $14.22 with a corresponding P/E ratio of 14.47x.

Management Notes: “During the first quarter we signed an agreement to build another 5,000 square foot warehouse on the Beechwood Avenue property, that once completed, will create additional storage space for up to 200 pallets of inventory. With this expansion we will also be creating a new holding area for our clients as well as additional space in the SEEK factory. We upgraded our delivery fleet and plan to add an additional 3 delivery vehicles throughout the year in both Kingston and Montego Bay. Our Montego branch will also get some needed upgrades as we have signed an agreement to double our storage capabilities, resulting in increased inventory for Montego Bay. This is a necessity with Montego Bay experiencing an uptake in tourist arrivals allowing hotels, restaurant and several other businesses to once again have an opportunity to flourish.”

Balance Sheet Highlights:

Total assets as at March 31, 2023 increased 49% to $1.52 billion (2022: $1.02 billion). This movement was primarily due to a 65% increase in ‘Property, plant and equipment’ to $627.43 million (2022: $380.37 million) and a 148% increase in ‘Bank and cash’ to $296.07 million (2022: $119.28 million).

Shareholders’ equity as at March 31, 2023 increased 53% to $1.20 billion (2022: $781.72 million) resulting in a book value per share of $4.79 (2022: $3.13).

Disclaimer:

Analyst Certification – The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure – The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may affect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.