February 14, 2023

Spur Tree Spices Jamaica Limited (SPURTREE) for the twelve months ended December 31, 2022, reported a 20% increase in sales revenue to $1.03 billion from the $859.72 million reported in 2021. Revenue for the quarter rose 45% to $356.47 million compared to $245.42 million booked for the quarter ended December 31, 2021.

Cost of sales rose by 19% for the period to $689.38 million (2021: $577.42 million). Gross profit increased year-on-year by 20%, from $282.30 million in 2021 to $339.15 million in 2022. Gross profit for the quarter rose 10% to $100.90 million (2021: $91.85 million).

Administrative and other expenses rose by 35% to $192.58 million, up from the $142.26 million recorded a year prior. Management noted that, “the increase was mainly due to higher staff and rental costs, marketing spend and acquisition expenses.”

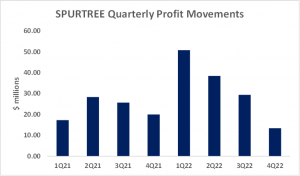

Operating Profit for the period grew by 5% to $147.05 million (2021: $140.27 million). Spur Tree reported fourth quarter profit of $25.06 million, a decline from $37.60 million twelve months earlier.

Profit before tax for the twelve months period closed at $134.94 million relative to $124.14 million reported twelve months earlier.

At the end of twelve months, SPURTREE reported a Net profit of $134.92 million relative to $91.32 million recorded for the corresponding period in 2021. While, for the quarter, net profit closed at $16.28 million (2021: $20.01 million).

Earnings per share (EPS) for the twelve months totaled $0.08 relative to $0.07 in 2021. EPS for the fourth quarter was $0.01 (2021: $0.02). The number of shares used in the calculation was 1,676,959,244 units. Notably, SPURTREE’s stock price closed the trading period on February 14, 2023 at a price of J$2.75 with a corresponding P/E ratio of 34.17 times.

Spur Tree indicated that, “We have acquired a property in Port Morant, St. Thomas to increase our productive capacity and maximize output from that area, as we diversity our offerings under the Spur Tree brand. The acquisition of majority stake in Canco Ltd represents our most significant investment for 2022. The Company owns and distributes products under the Linstead Market brand, with over 90% of its business being generated from exports. This investment gives us a much stronger presence in the lucrative ackee export market; however, our goal is to build and expand the iconic Linstead Market brand well beyond its current reach.”

Balance Sheet Highlights:

The Company, as at December 31, 2022, had total assets of $1.40 billion (2021: $596.68 million). This was primarily due to ‘Property, plant, and equipment’ which increased to $700.04 million (2021: $173.36 million). ‘Intangible assets’ also contributed to the overall asset growth valuing $89.48 million (2021: $11.39 million).

Total Stockholders’ equity as at December 31, 2022, closed at $728.42 million (2021: $411.26 million). This translated into a book value per share of $0.43 (2021: $0.25).

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may affect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.