Date: November 16, 2018

SSL Venture Capital Jamaica Limited (SSLVC) reported revenues of $58.56 million compared to $727,204 in the prior year. For the quarter, revenue amounted to $58.51 million (2017: $352,864). Management highlighted that, “revenue was generated via the company’s Venture Capital operations. In keeping with our investment strategy, SSL Ventures purchased equity stakes in early stage companies that showed strong growth potential to enable an exit on investment via an IPO or Trade Sale within a 3 year time horizon. The company’s revenue growth for the quarter ended September 30, 2018 was largely driven by the company’s equity investments in Bar Central Limited, Blue Dot Intelligence Limited and Muse 360 Integrated Limited.”

SSLVC incurred $84.54 million for administrative expenses relative to $3.70 million reported in 2017. While for the quarter, administrative expenses totaled $76.18 million (2017: $1.90 million).

Consequently, operating loss for the period closed at $25.99 million (2017: $2.97 million). SSLVC reported an operating loss for the quarter of $17.67 million versus an operating loss of $1.55 million booked for the same quarter in 2017.

The Company recorded finance cost of $370,850 for the nine months relative to $621,644 for the prior year’s corresponding period. For the quarter, finance cost went up 82% from $197,843 to $359,455 in 2018.

Sponsorship income for the nine months amounted to $1.61 million relative to $195,240 twelve months earlier. The company booked $19.74 million for ‘Realized income due to AP and loan written off’ in 2018 compared to nil in 2017.

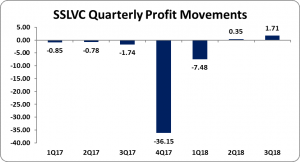

As such, loss before tax amounted to $5.02 million compared to a loss of $3.40 million for the corresponding period in 2017. SSLVC booked profit before tax of $1.71 million for the third quarter relative to a loss of $1.74 million in 2017.

Taxes incurred for the period amounted to $407,272 (2017: nil), resulting in a nine months net loss of $5.42 million relative to a loss of $3.40 million booked for the prior year’s corresponding period. As for the third quarter, the company reported a profit of $1.71 million versus a loss of $1.74 million in the previous corresponding period.

Loss per share (LPS) for the nine months period amounted to $0.0014 (2017: $0.0008). Earnings per share (EPS) for the quarter amounted to $0.0043 versus a loss per share of $0.0044. The trailing loss per share amounted to $0.104. The number of shares used in our calculations is 400,000,000. SSLVC stock price closed the trading period at a price of $1.77 on November 16, 2018.

The company mentioned that, “SSL Ventures will continue to work with the three aforementioned companies to execute its mandate to realize shareholder returns via an exit through an IPO or private sale within three years. We are also working towards making investments in other private companies that show great promise in regard to revenue growth and profitability.”

SSLVC stated that:

Bar Central Limited is a distribution and branding company that experienced revenue growth largely from the expansion of the fleet to further its distribution network as well as the addition of several high margin products to the company’s portfolio. The company also continues to grow its marketing execution line of business through branding of various bars and wholesale locations island wide.

Blue Dot Data Intelligence Limited is the Caribbean’s leading insights agency providing critical decision support services including qualitative and quantitative market research, data driven strategy recommendations, social media optimization solutions and management consulting services.

Muse 360 Integrated Limited is a full service marketing agency and content production company. The company continued to expand the number of brands under management ultimately translating to an increase in revenue.

Balance sheet at a glance:

As at September 30, 2018, total assets amounted to $203.20 million up from the $37.94 million booked in 2017. This increase was mainly due to an increase in ‘Property and Equipment’ and ‘Receivables’ which closed at $23.16 million (2017: $58,312) and $47.87 million (2017: $2.55 million), respectively.

Shareholders’ Equity closed at $120.42 million relative to $5.34 million recorded in the prior year’s corresponding period. This resulted in a book value per share of $0.30 (2017: $0.01).

Disclaimer: Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.