December 14, 2021

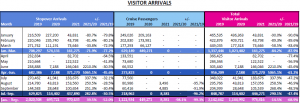

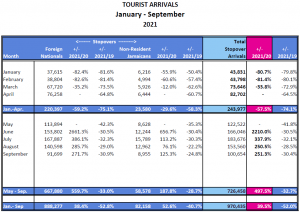

Stopover arrivals in September 2021 were 100,654 – representing a 251.3% increase over the 28,648 recorded in 2020, however, arrivals were 30.4% down on the 144,583 arrivals recorded in September 2019. Optimistically, For the January to September period, arrivals increased by 39.5%, with 970,435 stopovers recorded, this is 274,714 more stopovers compared to the 695,721 in 2020.

Statistics based on segment:

USA – Stopover arrivals from the United States market recorded a total of 88,383 arrivals in September 2021. The Northeast US marketing regions recorded 37,904 arrivals, the South recorded 27,004, the Mid-West recorded 13,082 and the West recorded 10,393 arrivals.

For the January to September period, the US market region has increased by 85.8% with 893,990 arrivals. The Northeast was up by 87.9%, the South up by 127.1%, the Midwest up by 17.2% and the West region up by 138.8%

Canada – Air service continued in September 2021 but only with flights from the gateway of YYZ Toronto (Toronto Pearson International Airport). The Canadian market recorded 5,053 arrivals. Majority of stopovers came from Central Canada with 4,516 arrivals. Cumulatively, the Canadian market with 22,061 visitors has recorded a decrease of 81.3% or 95,707 less visitors than in 2020. The top producing provinces of Ontario with 18,555 fell by 77.6%, and those from Quebec, with 1,265 visitors fell by 92.2%.

Europe – Air service increased during September 2021, with flights from the gateways BHX, LGW, LHR and MAN in the UK and FRA Germany and ZRH Switzerland. Stopovers from the European market region recorded 4,820 arrivals in September 2021. From the Northern European region, 3,909 visitors were recorded. From the South-Western European region 747 visitors and from Central-East Europe 164 arrivals. For the January to September period, arrivals decreased by 47.1%, with 36,230 stopovers, this is 32,320 less stopovers compared to the 68,550 recorded during the same period in 2020.

Latin America – Arrivals from Latin America recorded 519 in September 2021. From the Central American region, stopover arrivals recorded 367. Mexico with 154 arrivals and Panama with 130. From the South American region, stopover arrivals recorded 152 arrivals. Uruguay with 80 arrivals, Ecuador with 17 arrivals and Chile with 13 arrivals. Cumulatively, January to September 2021, stopover arrivals from Latin America declined by 67.7%, with a total of 4,145 arrivals, which was 8,670 less visitors compared to the same period in 2020. Stopovers from Central America with 2,390 arrivals rose by 12.9%. Stopover arrivals from South America fell by 83.6% with 1,755 arrivals.

Asia – The Asian market recorded a total of 105 stopovers in September 2021. China, India and the Philippines, are the major visitor-producing countries with 35, 25 and 24 stopovers arriving from each country, respectively. Year to date, stopovers for the January to September period fell by 24.0% moving down from 1,331 in 2020 to 1,011 in 2021.

The Caribbean – Stopover arrivals to Jamaica from the Caribbean region in September 2021

were 1,663. The Bahamas Is. and the Cayman Is. were the major visitor producing Caribbean countries in September 2021 with 258 and 257 stopover arrivals, respectively. Year to date, stopovers for the January to September period fell by 5.8% moving down from 12,796 in 2020 to 12,056 in 2021.

Other Countries – Overall, stopover arrivals recorded from other countries were 942 arrivals, for the January to September 2021 period. Of the Other Countries, Africa provided the most stop-over arrivals to Jamaica, with 389 visitors compared to 337 in 2020. This represents an increase of 15.4%.

Statistics on Length of Stay:

The average length of stay of Foreign National arrivals in September 2021was 9.0 nights. The average length of stay in hotels was 6.2 nights in September 2021. The average length of stay of Non‐Resident Jamaican arrivals in September 2021 was 28.7. The average length of stay in hotels in September 2021 was 8.9 nights. During the January to September 2021 period, the average length of stay for Foreign National arrivals in all types of accommodations was 8.8 nights compared to 8.6 nights in 2020. For the Non-Resident Jamaican arrivals, the average length of stay was 24.7 nights compared to 19.3 nights.

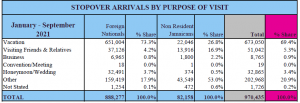

Statistics on Purpose of Visit:

During the month of September 2021, 78.2% or 71,732 of the 91,699 Foreign Nationals visited Jamaica for Leisure, 1.1% were on Business, 20.5% were on other purposes of travel and 0.2% did not state their purpose of travel. A total of 3,450 or 38.5% of the 8,955 Non‐Resident Jamaicans were visiting for Leisure, 2.0% were on Business, 58.9% were on other purposes of travel and 0.6% failed to provide a reason for travel. Year-to-date January to September 2021, 78.0% or a total of 756,957 of the total stopover arrivals of 970,435 visited Jamaica for Leisure, 0.9% were on Business, 20.9% were on other purposes of travel and 0.2% did not state their travel purpose.

Statistics on Intended area of stay by tourists:

Of the 153,560 stopover arrivals visiting Jamaica in September 2021, the resort area of Montego Bay welcomed 60,840 arrivals or 39.6%; Ocho Rios received 30,349 or 19.8%, Negril welcomed 29,353 or 19.1%; and 10,329 or 6.7% visited Kingston. The remaining 14.8% stayed in the Mandeville/South Coast, Port Antonio resort regions and other areas in Jamaica. Between January and September 2021, the combination of Montego Bay, Negril, and Ocho Rios accounted for 683,861 or 78.6% of the 869,781 total stopover arrivals.

Statistics on Airlines used by Tourists:

Of the 970,435 stopover visitors to Jamaica during the period January to September2021, 958,959 or 98.8% used scheduled airlines, while 11,476 or 1.2% used chartered flights. During the corresponding period in 2020 the percentage distribution was: 92.5% used scheduled airlines and 7.5% used chartered flights.

(source: Jamaica Tourist Board)

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herei