February 28, 2019,

Supreme Ventures Limited (SVL) for the year ended December 31, 2018, reported a 11% increase in Total Gaming Revenue from $29.68 billion in 2017 to $32.94 billion in 2018. Management noted the, “When compared to 2017, the Group achieved record Gross Ticket Sales of approximately $62 billion in 2018, representing a 12.3% increase.” Revenues from the company’s segments were as follows:

- Lottery – $2.78 billion (2017: $2.62 billion), a 6% increase.

- Horseracing – $6.12 billion (2017: $4.66 million) a 31% increase.

- VTL Gaming – $353.93 million (2017: $363.08 million) a decline of 3%.

- Pin codes – $9.88 billion (2017: $9.86 billion), a marginal increase of 0.3%.

- Other – $344.87 million (2017:$256.61 million), a 34% increase

Direct expenses recorded an increase to close the year at $26.44 billion when compared to $24.07 billion for the same period in 2017. As such, gross profit for the year improved 16% to $6.49 billion (2017: $5.61 billion).

Operating expenses grew by 12% for the period to $3.84 billion (2017: $3.42 billion) while other income declined 6% to $244.05 million (2017: $237.66 million)

The Company also booked no net impairment losses on intangible assets relative to a loss of $318.11 million 2017. Consequently, operating profit for the period increased 37% to $2.87 billion relative to $2.10 billion reported in 2017.

Finance costs declined 8% for the period to total $56.03 million (2017: $60.86 million). The company also recorded revaluation gain in investment property of $72.50 million relative to $4.73 million in 2017. As such, Profit before Taxation amounted to $2.89 billion, up from $2.05 billion in 2017.

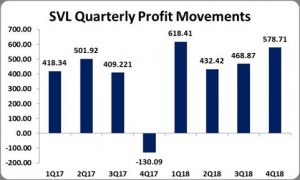

Taxation for the year rose 22% to close at $790.03 million in compared to $647.71 million in 2017. Net Profit after tax amounted to $2.10 billion, a 50% increase from the $1.40 billion recorded for the prior financial year.

Earnings per share totaled $0.80 for the year (2017: $0.53). The number of shares used in our calculations 2,637,254,926 units. Notably, SVL’s stock price closed the trading period on February 28, 2019 at a price of $20.23.

Management noted“Total Comprehensive Income of approximately $2.1 billion, reflects our drive, focus and execution of core strategic initiatives such as our channel expansion into the mobile gaming arena and the kick-off of our regional expansion plans.”

Balance Sheet at a glance:

As at December 31, 2018, Supreme Ventures Limited had assets totaling $6.62 billion relative to $6.38 billion a year earlier. The increase was due mainly to a 22% and 6% increase in ‘Cash and Bank Balances’ and ‘Property, plant and equipment’. ‘Cash and Bank Balances’ and ‘Property, plant and equipment’ closed the year at $2.98 billion (2017: $2.44 billion) and $1.24 billion (2017: $1.16 billion)

Shareholders Equity amounted to $3.29 billion (2017: $3.32 billion) with a book value per share of $1.25 (2017: $1.26).

The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any Action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.