March 1, 2022

Supreme Ventures Limited (SVL), for the year ended December 31, 2021, reported a 12% increase in ‘Total Gaming Revenue’ from $39.36 billion in 2020 to $43.92 billion in 2021. While, for the quarter, ‘Total Gaming Revenue’ closed at $12.21 billion (2021: $11.42 billion). According to SVL, “The Group continues to leverage our fixed distribution network by investing in new complimentary businesses and product lines. In 2021, we launched several new products and channels in keeping with our promise to provide ease and convenience through increased digitization for our customers. Supreme’s focus on digitization and improving the mobile offering for lotteries, sports betting, and horseracing, continues to be seen as an area of opportunity to enhance the customer experience.”

Revenues from the Company’s segments were as follows:

- Revenue from ‘Non fixed odd wagering games, horse racing and pin codes’ amounted to $26.39 billion (2020: $22.85 billion), a 16% increase.

- Income from fixed odd wagering games, net of prizes totaled $17.53 billion (2020: $16.51 billion), a 6% rise.

Direct expenses recorded rose to close the period at $34.59 billion when compared to $30.61 billion for the same period in 2020. SVL noted that, “Direct costs include contributions to Government agencies and related bodies of over $9 billion, a record increase of 8.50%, or $708.85 million over 2020. Supreme Ventures Limited continues to be one of the largest contributors to the Government coffers at multiple times our profitability.” As such, gross profit for the period improved 7% to $9.38 billion (2020: $8.75 billion). For the quarter, gross profit amounted to $2.84 billion (2020: $2.76 billion).

Selling, general and administrative expenses grew 24% for the period to $6.16 billion (2020: $4.95 billion), while recording ‘Other income’ of $221.78 million relative to $126.67 million for the prior period in 2020.

Net impairment losses on intangible assets closed at $120.23 million (2020: $22.06 million). Consequently, operating profit for the period fell 15% to $3.33 billion relative to $3.90 billion reported in 2020. Operating profit for the quarter totaled $1.16 billion (2020: $1.47 billion).

Finance costs fell to $30.40 million (2020: $269.87 million). The Company also recorded a revaluation loss on investment property of $18.74 million (2020: $34.95 million). As such, profit before taxation amounted to $3.28 billion, down from $3.60 billion in 2020. While, for the quarter, profit before taxation closed at $1.06 billion (2020: $1.32 billion).

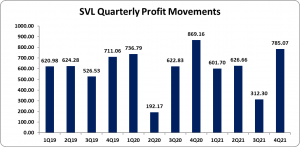

Taxation for the year fell 19% to close at $951.38 million compared to $1.18 billion in 2020, thus resulting in net profit of $2.33 billion, a 4% decrease from the $2.42 billion recorded in the prior comparable period. For the quarter, net profit closed at $785.07 million (2020: $869.16 million).

Net profit attributable to shareholders amounted to $2.29 billion versus $2.38 billion booked in the prior corresponding period. For the quarter, net profit attributable to shareholders totaled $770.44 million (2020: $836.55 million).

Earnings per share totaled $0.87 versus $0.90 in the previous period in 2020. While, for the quarter, earnings per share closed at $0.29 (2020: $0.32). The number of shares used in our calculations 2,637,254,926 units. Notably, SVL’s stock price closed the trading period on February 28, 2022 at a price of $17.95 with a corresponding P/E of 20.66x.

Management noted, “The Group generated positive cash flows from operations of $2.77 billion to close on December 31st, 2021, with a balance of $4.37 billion representing a decrease of 30.12% over prior year. This decrease is attributable to the business acquisitions completed during the year, purchase of other fixed assets, payment of dividends and taxes. All of which were to position the Group for further growth after the pandemic and easing of restrictions. The Group met all requirements and covenants under the terms of agreement with bondholders and other credit facilities during the year.”

Balance Sheet at a glance:

As at December 31, 2021, Supreme Ventures Limited had assets totaling $17.23 billion relative to $15.58 billion a year earlier. The increase was due mainly to a 48% and 77% increase in ‘Property, plant and equipment’ and ‘Trade and other receivables’ which closed at $4.20 billion (2020: $2.84 billion) and $2.57 billion (2020: $1.45 billion), respectively.

Shareholders Equity amounted to $4.23 billion (2020: $4.20 billion) with a book value per share of $1.60 (2020: $1.59).

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.