August 31, 2020

The Company also reported Fair Value Gains of US$74,640 (2019: US$135,429) and Participation fees of US$7,000 (2019: US$50,944). Management noted the reduced gains, “reflected higher interest rates and widening credit spreads due to the global COVID-19 pandemic.”

As such, Sygnus reported year end revenue of US$4.57 million compared to US$3.35 million. For the quarter, Sygnus booked revenue of US$975,649 versus US$645,412 for the quarter ended June 31, 2019. “Ninety-nine point eight percent of core revenues were comprised of net interest income. Timing differences between the interest expense associated with new debt, and interest income earned from the deployment of that debt into new investment commitments, adversely affected the growth of core revenues. These differences should normalize over time,” as per Management.

Total Expenses for the year amounted to US$2.62 million, a 101% surge relative to US$1.30 million recorded for the corresponding period in 2019. Total expenses for the quarter amounted to US$297,400 relative to US$523,450 for the same quarter of 2019. The Company noted that this increase in expenses, “was driven primarily by higher management fees which rose by US$298.8 thousand or 42.3%, in accordance with a 60.0% growth in assets under management. Management fees are charged at a rate of 1.9% of assets under management.” Of expenses:

Management fees amounted to US$1.01 million (2019: US$707,175).

Other expenses for the period amounted to US$463,958 (2019: US$302,958). Loss on sale of investments was $8,370 for the year ended June 2020.

Impairment Allowance on Financial Assets for the year amounted to US$101,593 versus US$74,645 for 2019. Regarding Impairment Allowance on Financial Assets, the Company noted that, “during the third quarter of FYE Jun 2020, 1 Portfolio Company’s investment with a value of US$1.43 million was moved to Stage 3 or the default category. This reclassification was done as the private credit investment terms for this Portfolio Company are being changed / restructured to better align its business prospects with the current global COVID-19 pandemic. The restructuring exercise was still ongoing as at FYE Jun 2020 and represented SCI’s first restructuring since inception after two and a half years without any credit related issues. The discounted value of the collateral for this Portfolio Company was larger than SCI’s outstanding investment, which resulted in nil ECL being reflected for this investment as at FYE Jun 2020. The non-performing investment rate (NPI) was 2.7% of SCI’s total Portfolio Company investments. 1 Portfolio Company with a value of US$1.24 million falls under the enhanced monitoring category, with an ECL of US$18.65 thousand. SCI does not have any realized losses from defaulted investments.”

Moreover, Management indicated, “excluding management fees, operating expenses increased by US$161.0 thousand, or 53.1% to US$464.0 thousand vs US$303.0 thousand for FYE Jun 2019. This increase was primarily driven by corporate service fees, commitment fees and registration fees. Corporate services fees reflected accrual expenses for a new contract with a related party covering the provision of accounting and other corporate services. Commitment fees reflected one-time expenses relating to the establishment of bank credit lines during the financial year.”

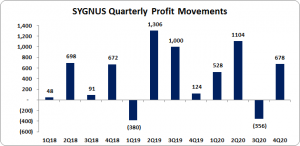

Profit for the year of US$1.95 million was booked for 2020, relative to US$2.05 million in 2019, a 5% decrease year over year. For the quarter the Company booked US$678,249 compared to US$121,962 for the same quarter of 2019.

Total comprehensive income for the year ended June 2020, amounted to US$1.97 million (2019: US$2.05 million).

As a result, earnings per share (EPS) for the year amounted to US$0.0056 (2019: USD$0.0059). EPS for the quarter amounted to US$0.004 (2019: US$0.001). The number of shares used in our calculations amounted to 350,087,563 units. Notably, SCIUSD and SCIJMD closed the trading period on August 31, 2020 at a price of $13.06 and $15.76 respectively. Both SCIJA and SCIUS closed the trading period on September 16, 2020 at US$0.13 and US$0.14.

Management indicated, “SCI’s results were driven by a record origination of private credit investments across the Caribbean region, in keeping with its mandate to drive the velocity of financing for middle-market companies, via the alternative investment channel. The results were partially adversely impacted by the one-off conversion of J$1.2 billion to USD being part proceeds of new JMD debt that was raised and part proceeds of JMD investments that were exited during the third quarter. The results were also impacted by the one-off unscheduled investment exit of US$10.30 million during the third quarter, due to the onset of COVID-19. The impact of the global Covid-19 pandemic on SCI’s business is an ongoing evaluation process as the crisis unfolds. However, SCI remains well positioned from a liquidity, funding profile and capital standpoint to play a major role in financing the recovery and growth of Caribbean middle-market firms, while proactively managing the risks of its diversified portfolio of investments.”

Moreover, Sygnus highlighted its Portfolio Company Investment Commitments stating, “SCI originated and financed new investment commitments valued at a record US$54.73 million during FYE Jun 2020 vs US$20.70 million in FYE Jun 2019, gross of investment exits, amortizations. Significant Exit: During the third quarter of the financial year, there was an unscheduled early exit valued at US$10.3 million. This large exit was primarily driven by COVID19 developments, which temporarily delayed the use of funds by the Portfolio Company. The early exit was mutually agreed between SCI and the Portfolio Company. Fair value of investments in Portfolio Companies would have been larger had it not been for this significant unscheduled exit.”

Regarding allocation by Industry and Country of Incorporation, “SCI’s Portfolio Companies were diversified across a record 10 major industries in FYE Jun 2020, up from 8 the preceding year. Excluding Dry Powder, the top four industry allocations were Infrastructure (19%), Manufacturing (18%), Hospitality (15%) and Distribution (11%),” as noted by the Company.

Sygnus also stated that, “SCI expanded its regional footprint to a record 7 Caribbean territories in FYE Jun 2020, up from 5 the prior year, with its first investments in the Bahamas, and the SSS Islands (Saba, St Martin and St Eustatius) of the Dutch Caribbean. Portfolio Companies from Jamaica accounted for the highest allocation of SCI’s Portfolio at 50%, coming down from 59% the prior year.”

Balance Sheet Highlights

As at June 30, 2020, Sygnus’ total assets amounted to US$61.04 million, a 60% increase on 2019’s assets base of US$38.15 million. This was due to an increase in ‘investments’ to US$51.55 million (2019: US$32.39 million) and ‘Securities purchased under resale agreements’ which was declared at US$2.50 million (2019: US$1.04 million). Cash and Cash Equivalents jumped to US$3.01 million as at June 30, 2020 from US$2.10 million as at June 30, 2019.

Total Stockholders’ equity as at June 30, 2020, closed at $37.67 million, relative to $37.59 million for the corresponding period last year. This resulted in a book value per share of US$0.20 compared to the value of $0.20 as June 30, 2019.

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.