February 14, 2020

In United States dollars (except where it is indicated otherwise):

Sygnus Credit Investments Limited, for the six months ended December 31, 2019, reported Interest Income of US$2.47 million 69% increase on the US$1.46 million recorded in 2018. For the quarter, Interest Income rose 57% to US$1.35 million (2018: US$856,155). Interest expense amounted to US$116,736 for the six months (2018: nill). As a result, net interest income for the period amounted to US$2.36 million (2018: nil).

The Company also reported Fair Value Gains of US$305, 191 (2018: US$33,904) and Participation fees declined to US$7,000 (2018: US$30,944).

As such, Sygnus reported total revenue of US$2.67 million compared to US$1.53 million. For the quarter, Sygnus booked revenue of US$1.58 million versus US$1.57 million for the quarter December 31, 2018.

Total Expenses for the period amounted to US$1.04 million, a 81% increase relative to US$571,148 recorded for the corresponding period in 2018. Total expenses for the quarter amounted to US$473,985 relative to US$268,163 for the same quarter of 2018. Of expenses:

Net foreign exchange loss totalled US$303,865, (2018: US$60,509).

Management fees amounted to US$434,346 (2018:US$349,307).

Other expenses for the period amounted to US$41,821 (2018: US$28,503).

Audit Fees rose 45% year over year from US$8,037 in 2018 to US$11,638 for the first six months of 2019.

Directors Fees and Related Expenses rose 10% to close at $US16,748 (2018: US$15,246).

Irrecoverable Withholding Tax and Professional Fees amounted to US$289 (2018: US$35,264) and US$3,173 (2018: US$8,311) respectively.

Management noted, “These increases were primarily driven by one-off commitment fees relating to the establishment of bank credit lines and higher accounting fees from reorganization of accounting functions.”

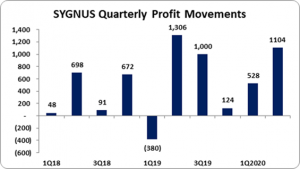

Profit for the period of US$1.63 million was booked, relative to US$955.58 in 2018, a 71% increase year over year. For the quarter the Company booked profit of US$1.10 million compared to US$1.31 for the same quarter of 2018.

As a result, Earnings per share (EPS) for the period amounted to US$0.0047 (JMD: $0.618) relative to an earnings per share of US$0.0027 (JMD: 0.349) for 2018. EPS for the quarter amounted to US$0.0032 (2018: US$0.0037). The twelve months trailing eps amounted to US$0.0078. The number of shares used in our calculations amounted to 350,087,563 units. Notably, SCIJA and SCIJMD closed the trading period on February 14, 2020 at a price of $13.06 and $24.22 respectively. SCIUS and SCIUSD closed the trading period on February 13, 2019 at US$0.13 and US$0.16 respectively.

Sygnus stated, “SCI executed its first set of investments in the Dutch Caribbean islands of Sint Maarten, Saba and St. Eustatius (SSS Islands),bringing its Caribbean footprint to 5 territories in Q2 Dec 2019, up from 4 in the preceding quarter of Q1 September 2019. Portfolio Companies from Jamaica accounted for the highest allocation of SCI’s Portfolio with 44%, followed by the Cayman Islands with 27% and the SSS Islands of the Dutch Caribbean with 19%.”

Additionally Management noted, “SCI was successful in raising capital via the debt market for the first time in December 2019, when it issued US$15 million equivalent in medium-term notes to fund its investment activity. A quarter of this financing was undrawn as at the end of Q2 Dec 2019. SCI also established revolving credit lines with major banking institutions and utilized other shortterm credit facilities to fund its growth during the quarter.”

Sygnus highlighted, “Private credit is one of the youngest asset classes in the alternative investment ecosystem within the Caribbean, and indeed the world. However, the asset class has grown to become an important financing channel for middle-market companies globally and is now the third largest asset class within private capital, on the path to US$1 trillion within the next few years. SCI has been a pioneer in the regional private credit market and intends to continue expanding the market by strategically building long term relationships with investors, middle-market firms and other stakeholders. SCI’s solutions are customized to align with the growth strategy of middle-market companies, and this has resulted in a robust pipeline of opportunities across various industries such as manufacturing, energy, distribution, hospitality and financial services in multiple Caribbean territories.”

Balance Sheet Highlights

As at December 31, 2019, Sygnus’ total assets amounted to US$61.29 million, a 61% increase on 2018’s assets base of US$38.02 million. This was due to an increase in ‘cash at bank’ to US$5.48 million (2018: US$1.81 million) and ‘Finance lease receivables which rose to US$142.69 million (2017: 63,213). ‘Other receivables’ jumped from US$721 as at December 31, 2018 to US$14,477 as at December 31, 2019.

Total Stockholders’ equity as at December 31, 2019, closed at $38.35 million, a 3% increase from $37.10 million for the corresponding period last year. This resulted in a book value per share of US$0.110 (2018:US$0.106).

Analyst Certification -This research report is for information purposes only and should not be construed as a recommendation. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation (s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.