November 14, 2022

Sygnus Credit Investments Limited

Unaudited financials for the three months ended September 30, 2022

In United States dollars (except where it is indicated otherwise)

Sygnus Credit Investments Limited, for the three months ended September 30, 2022, reported Interest Income of US$2.78 million, a 24% increase on the US$2.24 million recorded in 2021. However, this increase was offset by a 193% increase in Interest expense to US$1.22 million (2021: US$416,011). As a result, Net Interest Income for the period contracted 14% to US$1.56 million (2021: US$1.82 million). The company noted, “SCI has advanced the discussions with its international financing partners to secure large credit facilities that will allow for the creation of new revenue streams, while it embarks on unlocking the true potential of the private credit channel across the English, Dutch and Spanish-speaking Caribbean.”

The Company reported other income of US$19,006 (2021: nill).

Fair Value Gains increased by 120% to US$986,055 (2021: US$448,765). Management stated, “The financial results for the first quarter were driven by a record portfolio of private credit investments, “investment income” from the underlying value of the investment in Acrecent Financial Corporation in Puerto Rico, continued disciplined investment origination and the structuring of investments with adequate downside protection to manage risk exposures. SCI’s private credit portfolio remains resilient and well positioned to navigate the ongoing volatility of a high inflation, high interest environment, with a robust, lowly leveraged balance sheet and a robust pipeline of investments.”

As such, Sygnus reported three months total income of US$2.57 million compared to US$2.27 million.

Total Expenses for the quarter amounted to US$879,067, a 20% increase on the US$735,261 recorded for the corresponding period in 2021. The Company noted that this increase in expenses was, “driven primarily by higher management fees and higher corporate services fees related to larger assets under management. Management fees and corporate services fees were a combined 72.0% of operating expenses for 3 Months 2022 relative to 74.7% in 3 Months 2021. There were no performance fees charged for this period relative to US$50.9 thousand in Q1 Sep 2021.” Of expenses:

- Management fees amounted to US$548,756 (2021: US$442,875).

- Other expenses for the period rose to US$252,255 (2021: US$124,797).

- No Performance fees were recorded for the period under review (2021: US$50,939).

- Net foreign exchange loss totalled US$55,019 (2021: Gain of US$10,325).

- Corporate services fee totalled US$98,462 (2021: US$77,177).

- Impairment Allowance on Financial Assets for the three months amounted to US$34,613 versus US$29,148 for 2021.

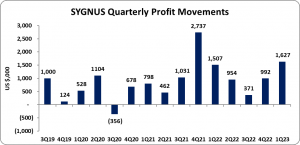

Pretax profit for of US$1.69 million was booked for 2022, relative to US$1.54 million in 2021, a 10% incline year over year.

After a taxation charge of US$60,634 (2021: US$30,223), Sygnus booked Profit for the three months of US$1.63 million (2021: US$1.51 million).

As a result, earnings per share (EPS) for the three months amounted to US$0.0028 (2021: USD$0.0025). The trailing twelve months EPS amounted to US$0.0067. The number of shares used in our calculations amounted to 590,975,463 units. Notably, SCIJMD and SCIUSD, which trade on the Main Market, closed the trading period on November 11, 2022 at a price of $12.88 and $14.25 respectively. On the USD Market of the Jamaica Stock Exchange SCIJMD and SCIUSD closed the trading period on November 11, 2022 at US$0.1462 and US$0.0913.

Moreover, Sygnus highlighted its Portfolio Company Investment Commitments stating, “At the end of Q1 Sep 2022, SCI’s investment in Portfolio Companies grew by 46.3% to a record US$129.85 million vs US$88.8 million for Q1 Sep 2021. Included in this figure is the fair value investment of US$24.90 million in the Puerto Rico Credit Fund or PRCF, which is not consolidated all the way up to SCI based on the assessment of control. Portfolio Company investments included finance lease receivables carried on the balance sheet. The Group’s investment in Portfolio Companies, excluding the PRCF, grew by 18.2% to a record US$104.95 million vs US$88.76 million last year. The number of Portfolio Company investments excluding the PRCF remained flat at 33 versus last year, as smaller investment exits were replaced by larger new investments. Relative to FYE Jun 2022, 3 new Portfolio Companies were added.”

Balance Sheet Highlights

As at September 30, 2022, Sygnus’ total assets amounted to US$142.43 million, a 52% increase on 2021’s assets base of US$93.89 million. This was due to an increase in ‘Cash as bank’ to US$5.90 million (2021: US$1.06 million) and ‘Due from related companies’ US$1.61 million (2021:nil) .

Total Stockholders’ equity as at September 30, 2022, closed at $67.54 million, relative to $66.69 million for the corresponding period last three months. This resulted in a book value per share of US$0.11 compared to the value of $0.11 as at September 30, 2021.

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may affect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.