March 21, 2024

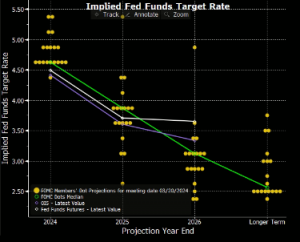

On March 20, 2024, the Federal Reserve opted to maintain the federal funds rate at its current level, 5.25% – 5.50%, aligning with market forecasts. Reiterating its commitment to achieving the 2% inflation target, the Fed emphasized the need for greater confidence in sustained inflationary movement before considering rate adjustments. Economic projections revealed upward revisions in GDP growth forecasts for both 2024 and 2025, alongside a lowered unemployment rate projection for 2024. While PCE inflation remained stable, Core PCE inflation saw a modest increase. Notably, the dot plot signalled three anticipated rate cuts in 2024, although the pace of reductions is expected to slow in subsequent years, suggesting a cautious approach to monetary policy adjustments.

The overall tone of the Fed’s projections appears moderately dovish, reflecting a balance between economic optimism and a prudent stance toward inflation. Market response hinges on Chairman Powell’s forthcoming remarks in the press conference, which will offer further insight into the Fed’s policy outlook and its implications for financial markets moving forward.

Federal Funds Target Rate

Dot Plot Graph

Disclaimer:

Analyst Certification – The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view (s) expressed by that research analyst in this research report.

Company Disclosure – The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may affect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.