December 13, 2023

Key Points:

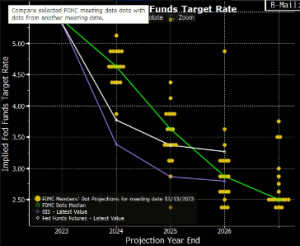

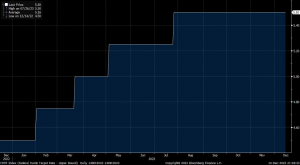

The Federal Reserve, in its third consecutive meeting, maintained unchanged interest rates and strongly suggested the conclusion of its previous aggressive rate-hiking strategy. The Fed’s forecast surprised economists by indicating a plan for three quarter-point cuts in the coming year. Additionally, policymakers anticipate a series of further reductions in the fed funds rate, with a median estimate of 3.6% by the end of 2025, as shared by 19 officials. The market responded broadly to the committee’s dovish stance.

During the recent meeting, Federal Reserve Chair Jerome Powell mentioned that the committee deliberated on potential rate cuts but didn’t dismiss the chance of a hike if supported by data. Despite this, the overall tone leaned towards a dovish shift. The Federal Open Market Committee (FOMC) signalled a more cautious approach to future rate increases by introducing a subtle change to its statement, stating that officials will evaluate the necessity of “any” additional policy tightening, underscoring a more flexible stance.

Despite a unanimous vote on Wednesday, notable divergences exist within the committee regarding their outlook on interest rates. Eight officials foresee fewer than three quarter-point cuts in the upcoming year, whereas five anticipate a more substantial number. In response to the latest inflation data, some Federal Open Market Committee (FOMC) participants adjusted their forecasts. While inflation projections were scaled back in the recent quarterly forecast, Federal Reserve Chair Jerome Powell acknowledged the adjustments but cautioned that the challenges related to inflation persist.

The committee aims for a gentle economic slowdown rather than a recession, projecting only a modest increase in unemployment over the next few years. Federal Reserve Chair Jerome Powell highlighted that the labour market is improving and approaching a better balance, with a slight cooling of wages, though they still slightly exceed the level consistent with 2% inflation. Powell emphasized the importance of both Federal Reserve mandates – full employment and price stability – noting the progress made in achieving these goals.

The financial markets welcomed the Federal Open Market Committee’s (FOMC) and Powell’s more dovish stance and are currently factoring in the probability of the initial rate cut occurring in March. The S&P 500 saw an increase, extending gains to 1%. Two-year Treasury yields experienced a decline of 25 basis points, settling around 4.5%. The dollar is approaching its lowest point since August. Swap contracts have been recalibrated to levels aligning with an anticipated 130 basis points of easing over the next 12 months.

Economic Projections:

During the Federal Open Market Committee (FOMC) meeting on September 19–20, 2023, participants provided their projections for key economic indicators such as real gross domestic product (GDP) growth, the unemployment rate, and inflation. These projections spanned from 2023 to 2026, along with longer-term estimates. Each participant’s forecasts were based on available information at the time of the meeting, their assessment of appropriate monetary policy, which includes the expected path of the federal funds rate, its longer-term value, and assumptions about other factors impacting economic outcomes.

The longer-term projections indicated the participants’ views on the values to which each economic variable would likely converge over time, assuming appropriate monetary policy and the absence of significant shocks to the economy. The term “appropriate monetary policy” refers to the future policy path that each participant believes is most likely to promote economic activity and inflation outcomes aligning with their interpretation of the statutory mandate. This mandate aims to achieve maximum employment and price stability.

Essentially, the meeting involved participants sharing their economic predictions based on current information and their individual assessments of the best monetary policy approach to meet the dual objectives of maximum employment and stable prices. These projections represent a collective insight into how policymakers perceive the economy evolving and how they envision the impact of monetary policy decisions on future economic indicators.

Federal Funds Dot Plot

Federal Funds Target Rate

Disclaimer:

Analyst Certification – The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view (s) expressed by that research analyst in this research report.

Company Disclosure – The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may affect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.