July 27, 2023

- The target range was raised by 25 basis points to 5.25% to 5.50% percent to address inflation and achieve maximum employment.

- Inflation remains high, which is a concern for the Committee.

- The overall goal is to return inflation to 2 percent while maintaining a sound and resilient banking system.

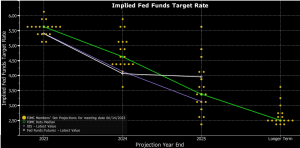

Federal Reserve Dot Plot

The Federal Reserve’s recent statement on monetary policy, released on July 26, 2023, indicates that the Board of Governors unanimously approved a .25 percentage point increase in the primary credit rate to 5.5 percent. It is also noted that the U.S. economy is experiencing moderate expansion. Job gains have been strong, and the unemployment rate remains low. However, inflation remains elevated, posing a challenge for the economy. To address inflation and achieve its goals of maximum employment and 2 percent inflation over the longer run, the Federal Open Market Committee (FOMC) has decided to raise the target range for the federal funds rate to 5.25 to 5.50 percent.

In addition to the interest rate hike, the Federal Reserve has made other decisions to implement the monetary policy stance:

- The interest rate paid on reserve balances was raised to 5.4 percent.

- The FOMC directed the Open Market Desk at the Federal Reserve Bank of New York to conduct open market operations to maintain the federal funds rate within the target range.

- Standing overnight repurchase agreement operations will have a minimum bid rate of 5.5 percent with an aggregate operation limit of $500 billion.

- Standing overnight reverse repurchase agreement operations will be conducted at an offering rate of 5.3 percent with a per-counterparty limit of $160 billion per day.

- The Federal Reserve will continue to reduce its holdings of Treasury securities and agency debt and agency mortgage-backed securities as previously announced.

The FOMC will closely monitor incoming information to assess the economic outlook and will adjust the stance of monetary policy as necessary to achieve its goals. The Committee’s assessments will consider a wide range of factors, including labor market conditions, inflation pressures, inflation expectations, and financial and international developments.

It is important to note that these decisions reflect the Federal Reserve’s efforts to balance economic growth and inflation while maintaining a sound and resilient banking system.

Note: The Federal Reserve has implemented a series of measures, including raising interest rates and conducting open market operations, to address inflationary pressures and achieve its long-term economic objectives.

Federal Funds Target Rate

Disclaimer:

Analyst Certification – The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view (s) expressed by that research analyst in this research report.

Company Disclosure – The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may affect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.