September 20, 2023

In its most recent meeting, the Federal Open Market Committee (FOMC) voted unanimously to keep the benchmark interest rate unchanged within the target range of 5.25%-5.50%, aligning with market expectations. However, the standout revelation from the meeting was the Fed’s updated projections for 2024 and 2025, signaling an expectation of considerably higher interest rates. This decision is rooted in the resilience of the U.S. economy, a robust labor market, and persistent inflationary pressures.

Key Points:

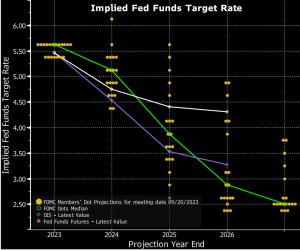

The “dot plot” of rate projections, a key indicator of the Fed’s stance, indicated that policymakers foresee higher rates in 2024 and 2025. While one more rate hike in 2023 is anticipated, the 2024 and 2025 rate projections each rose by half a percentage point. This adjustment reflects the Fed’s belief that interest rates will remain elevated for a more extended period.

Federal Reserve Dot Plot

The FOMC faces an ongoing debate regarding another rate hike in 2023. Among the committee’s members, 12 out of 19 believe that one more rate hike this year is appropriate, while the remaining seven advocate for maintaining current rates. Fed Chair Jerome Powell emphasized that the decisions would depend on incoming economic data.

Powell reiterated the FOMC’s objective of achieving a “soft landing” for the economy, minimizing harm to the labor market. While this outcome is plausible, it is not guaranteed. The committee has raised growth projections and anticipates a better-than-expected labor market, with the unemployment rate peaking at 4.1% instead of the previously expected 4.5%.

Despite the hawkish stance reflected in the dot plot, Powell struck a balanced tone during the meeting. He emphasized caution as rates approach their peak and highlighted that the risks of tightening too much versus too little have become “more two-sided.” Powell also underlined the uncertainty surrounding the economic outlook.

Powell reiterated the Fed’s commitment to addressing inflation concerns, emphasizing that “People hate inflation. Hate it.”

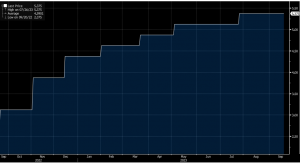

In response to the Fed’s announcements, Treasury two-year yields surged to their highest levels since 2006. Stock markets saw a decline, with the S&P 500 trending lower, and the Nasdaq 100 underperforming. The U.S. dollar exhibited fluctuations, while oil prices retreated from earlier highs.

Conclusion

The FOMC’s decision to keep interest rates unchanged and the revised rate projections for 2024 and 2025 reflect the Fed’s confidence in the U.S. economy’s strength. However, the debate within the committee about the timing of another rate hike in 2023 underscores the challenges and uncertainties in navigating the economic landscape. Fed Chair Jerome Powell’s balanced approach and commitment to addressing inflation concerns aim to guide the economy towards a “soft landing.” Nevertheless, the market’s reaction to these developments underscores the significance of the Fed’s decisions on various asset classes and the broader economic landscape.

Federal Funds Target Rate

Disclaimer:

Analyst Certification – The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view (s) expressed by that research analyst in this research report.

Company Disclosure – The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may affect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.