December 11, 2023

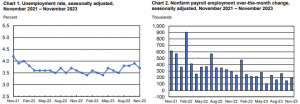

In November, total nonfarm payroll employment in the United States increased by 199,000, and the unemployment rate declined to 3.7 percent. Job gains were observed in the health care, and government, while employment in manufacturing also increased due to the return of workers from a strike. The U.S. Bureau of Labor Statistics reported these findings based on two monthly surveys: the household survey, which assesses labor force status, including unemployment by demographic characteristics, and the establishment survey, which measures nonfarm employment, hours, and earnings by industry.

Household Survey Data

In November, the U.S. unemployment rate declined to 3.7 percent, with 6.3 million unemployed individuals. Unemployment rates for different demographic groups edged down slightly in November, with adult men at 3.7 percent, adult women at 3.1 percent, teenagers at 11.4 percent, Whites at 3.3 percent, Blacks at 5.8 percent, Asians at 3.5 percent, and Hispanics at 4.6 percent. The number of long-term unemployed (jobless for 27 weeks or more) declined to 1.2 million, accounting for 18.3 percent of all unemployed persons. The labor force participation rate remained largely unchanged at 62.8 percent, while the employment-population ratio increased to 60.5 percent. There were 4.0 million individuals employed part-time for economic reasons, which means they preferred full-time work but were working part-time due to reduced hours or the inability to find full-time employment. Additionally, there were 5.3 million persons not in the labor force who wanted a job, and 1.6 million of them were marginally attached to the labor force. These individuals wanted to work and had looked for a job sometime in the prior 12 months but had not actively searched for work in the past four weeks. The number of discouraged workers, a subset of the marginally attached who believed that no jobs were available for them, remained largely unchanged at 421,000.

Establishment Survey Data

In November, total nonfarm payroll employment in the United States increased by 199,000 jobs, which was below the average monthly gain of 240,000 jobs over the previous 12 months. Job gains were observed in the health care sector (77,000 jobs), government (49,000 jobs), and manufacturing employment (28,000 jobs). However, retail trade employment declined by (38,000 jobs), particularly in department stores and furniture/electronics retailers. Other notable sectors with positive employment trends included leisure and hospitality, social assistance, and information, though the latter experienced an overall decline since its peak in November 2022. Meanwhile, transportation and warehousing employment remained relatively stable, with a slight decline of (5,000 jobs) in November.

In addition to the employment figures, the average hourly earnings for all employees on private nonfarm payrolls increased by 0.4 percent to $34.10 in November, reflecting a 4.0 percent increase over the past 12 months. The average workweek for all employees edged up by 0.1 hour to 34.4 hours, with manufacturing maintaining a steady average workweek of 40.0 hours. The revision of September’s total nonfarm payroll employment figures resulted in a downward adjustment of 35,000 jobs, bringing the combined employment figures for September and October 35,000 lower than initially reported. These revisions are standard and result from additional reports received from businesses and government agencies since the last published estimates, as well as the recalculation of seasonal factors.

Disclaimer:

Analyst Certification – The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view (s) expressed by that research analyst in this research report.

Company Disclosure – The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.