April 11, 2024

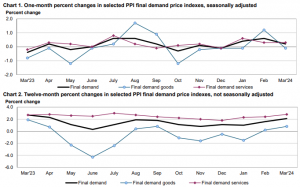

In March, the Producer Price Index (PPI) for final demand in the United States showed a modest increase of 0.2 percent, following larger jumps of 0.6 percent in February and 0.4 percent in January. This marks the highest 12-month advance since April 2023, with a 2.1 percent increase. The rise primarily stemmed from a 0.3 percent uptick in prices for final demand services, while prices for final demand goods experienced a slight dip of 0.1 percent. These fluctuations suggest a mixed picture for inflationary pressures, with services driving the overall increase while goods prices remained relatively stable.

The index for final demand excluding foods, energy, and trade services increased by 0.2 percent, following a 0.3 percent rise in February. Over the 12 months ending in March, prices for final demand excluding foods, energy, and trade services increased by 2.8 percent.

Final demand goods

The prices for final demand goods in the U.S. dropped by 0.1 percent in March, following a notable 1.2 percent increase in February. This decline was chiefly driven by a 1.6 percent drop in the index for final demand energy. Conversely, prices for final demand foods rose by 0.8 percent, while prices for final demand goods excluding foods and energy saw a slight uptick of 0.1 percent.

The March decline in the index for final demand goods in the U.S. was led by a 3.6 percent downturn in gasoline price. This decrease was accompanied by declines in the indexes for chicken eggs, carbon steel scrap, jet fuel, and fresh fruits and melons. However, there were notable exceptions, such as a significant 10.7 percent increase in processed poultry prices. Additionally, prices for fresh and dry vegetables, residential electric power, and motor vehicles saw upward movements during the same period.

Final demand services

The index for final demand services in the U.S. continued its upward trend with a 0.3 percent increase in March, marking the third consecutive rise. This broad-based increase was primarily led by a 0.2 percent advance in prices for final demand services excluding trade, transportation, and warehousing. Within the service sector, the indexes for final demand trade services and final demand transportation and warehousing services also saw gains, with increases of 0.3 percent and 0.8 percent, respectively.

The March increase in prices for final demand services in the U.S. was significantly influenced by several key factors, notably a substantial 3.1 percent rise in the index for securities brokerage, dealing, investment advice, and related services. Other contributing factors included increases in indexes for professional and commercial equipment wholesaling, airline passenger services, investment banking, deposit services (partial), and computer hardware, software, and supplies retailing. However, this upward trajectory was offset by declines in prices for traveller accommodation services, which decreased by 3.8 percent, along with drops in indexes for automobiles retailing (partial) and for machinery and equipment parts and supplies wholesaling.

Disclaimer:

Analyst Certification – The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer(s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view(s) expressed by that research analyst in this research report.

Company Disclosure – The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.