April 30, 2025

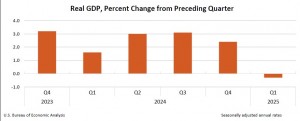

According to the advance estimate released by the U.S. Bureau of Economic Analysis, the U.S. economy experienced a slight contraction, with real GDP decreasing at an annual rate of 0.3% in the first quarter of 2025. This decline followed a 2.4% increase in the fourth quarter of 2024.

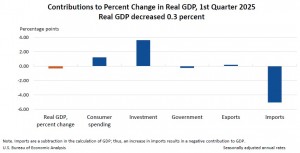

Key factors contributing to the GDP decrease included:

- Increase in imports: Imports subtract from GDP calculations, and the rise was primarily driven by consumer goods (excluding food and automotive) and capital goods (excluding automotive). Notably, medicinal, dental, and pharmaceutical preparations, including vitamins, and computers, peripherals, and parts were significant contributors.

- Decrease in government spending: This downturn in public sector expenditure significantly impacted the overall GDP. Federal government spending, particularly defence consumption expenditures, decreased, although this was partly offset by an increase in state and local government spending, led by compensation of employees.

Despite the contraction, there were positive contributions from:

- Investment: Private investment showed resilience and contributed positively to the GDP. The largest contributor was private inventory investment, particularly in wholesale trade, notably drugs and sundries.

- Consumer spending: Although decelerated compared to the previous quarter, consumer spending still added to the GDP. Increases were seen in both services (led by health care and housing and utilities) and goods (with nondurable goods increasing, partly offset by a decrease in durable goods).

- Exports: An upturn in exports also helped offset some of the negative impacts.

Inflationary pressures intensified during this period:

- The price index for gross domestic purchases increased by 3.4%, compared to a 2.2% rise in the fourth quarter of 2024.

- The personal consumption expenditures (PCE) price index rose by 3.6%, and core PCE inflation (excluding food and energy) increased by 3.5%.

Real final sales to private domestic purchasers, which exclude trade and government activity, increased by 3.0%, slightly up from 2.9% in the previous quarter. This indicates that private-sector demand remains robust despite broader economic headwinds.

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.