November 9, 2021

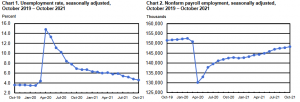

According to the Bureau of Labor Statistics, “total nonfarm payroll employment rose by 521,000 in October. Over the year, the rate has increased by 18.2 million since a recent trough in April 2020 but is down by 2.8 percent from its pre-pandemic level in February 2020.” The unemployment rate ticked down to 4.6 percent in October. The job growth was spread across various industries, with notable gains in leisure and hospitality, professional and business services, and manufacturing.

Household Survey Data

The number of unemployed persons, at 7.4 million, continued to trend down. Both measures are lower than the period of February – April 2020. However higher than the pre-corona virus (Covid 19) pandemic (3.5% and 5.7 million, respectively, in February 2020).

The unemployment rate for adult men declined (4.3 percent) in October. Among the major worker groups, the jobless rate for women and teenagers remained the same.

Among the unemployed, the number of permanent job losers, at 2.1 million, changed little in October but is 828,000 higher than in February 2020. The number of persons on temporary layoff, at 1.1 million, was little changed over the month. This measure is down considerably from the high of 18.0 million in April 2020 but is 306,000 above the February 2020 level.

In October, the number of long-term unemployed (those jobless for 27 weeks or more) decreased by 357,000 to 2.3 million but is 1.2 million higher than in February 2020. The long-term unemployed accounted for 31.6 percent of the total unemployed in October.

The labor force participation rate was unchanged at 61.6 percent in October and has remained within a narrow range of 61.4 percent to 61.7 percent since June 2020. The participation rate is 1.7 percentage points lower than in February 2020. The employment-population ratio, at 58.8 percent, was little changed over the month. This measure is up from its low of 51.3 percent in April 2020 but remains below the figure of 61.1 percent in February 2020.

The number of persons employed part-time due to economic reasons remained at 4.4 million in October. This figure shows that many of those individuals were unable to find full-time work.

The number of people not actively looking for work in October remained unchanged at 6.1 million. This figure was up by almost a million since February 2020. These individuals were not counted as unemployed because they were not actively looking for work during the 4 weeks preceding the survey or were unavailable to take a job.

Among the individuals not in the labor force looking for a job, the number remained at about 1.7 million in October. This figure was little changed from the previous month. The four weeks preceding the survey showed that they did not look for work.

Household Survey Supplemental Data

In October, 11.6 percent of employed persons teleworked because of the coronavirus pandemic, down from 13.2 percent in the prior month. These data refer to employed persons who teleworked or worked at home for pay at some point in the 4 weeks preceding the survey specifically because of the pandemic.

In October, 3.8 million persons reported that they had been unable to work because their employer closed or lost business due to the pandemic, that is, they did not work at all or worked fewer hours at some point in the 4 weeks preceding the survey due to the pandemic. This measure is down from 5.0 million in September. Among those who reported in October that they were unable to work because of pandemic-related closures or lost business, 13.3 percent received at least some pay from their employer for the hours not worked, little changed from the prior month.

Among those not in the labor force in October, 1.3 million persons were prevented from looking for work due to the pandemic. This measure is down from 1.6 million in September.

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view (s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein