September 13, 2023

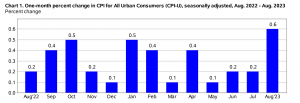

In August, the Consumer Price Index for All Urban Consumers (CPI-U) in the United States rose by 0.6 percent on a seasonally adjusted basis. This increase followed a 0.2 percent rise in July. Over the last 12 months, the overall price index increased by 3.7 percent before accounting for seasonal adjustments.

The main contributors to the monthly increase in August were the gasoline prices, which accounted for over half of the overall increase. Additionally, the housing market, as reflected in the shelter index, continued to rise for the 40th consecutive month. The energy index experienced a substantial increase of 5.6 percent in August, with all major energy components showing price increases. The food index also increased by 0.2 percent, mirroring the trend observed in July. Within the food category, prices for food at home increased by 0.2 percent, while prices for food away from home rose by 0.3 percent.

Excluding food and energy, the index for all other items increased by 0.3 percent in August, following a 0.2 percent increase in July. Some of the notable price increases in this category included rent, owners’ equivalent rent, motor vehicle insurance, medical care, and personal care. However, there were decreases in the indexes for lodging away from home, used cars and trucks, and recreation during the same period.

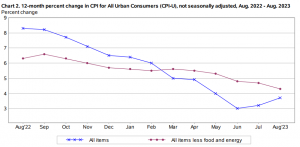

Looking at the 12-month trends, all items index increased by 3.7 percent for the 12 months ending in August, which is higher than the 3.2 percent increase observed for the 12 months ending in July. Meanwhile, the all items index excluding food and energy rose by 4.3 percent over the last 12 months. The energy index decreased by 3.6 percent for the 12 months ending in August, while the food index increased by 4.3 percent over the same year-long period.

Disclaimer:

Analyst Certification – The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer (s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view (s) expressed by that research analyst in this research report.

Company Disclosure – The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.