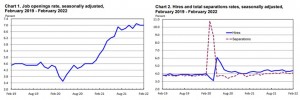

According to The US Bureau of Labor Statistics, the number of job opportunities remained stable at 11.3 million on the final business day of February. Hires increased slightly to 6.7 million, while total separations stayed steady at 6.1 million. Within separations, the quit rate remained relatively stable at 2.9 percent, and the layoffs and discharges rate remained stable at 0.9 percent. This report includes estimates of job vacancies, hires, and separations in the overall nonfarm sector, by industry, by four geographic areas, and by establishment size class.

Job Openings

On February’s final business day, the quantity and rate of job openings were little change at 11.3 million and 7.0 percent, respectively. Job openings decreased in finance and insurance (-63,000) and in nondurable goods manufacturing (-39,000) .Job openings increased in arts, entertainment, and recreation climbed by 32,000 (+32,000); educational services increased by 26,000 (+26,000); and federal government increased by 23,000 (+23,000). The Midwest area had a decline in job postings, while the West region saw an increase.

Hires

Hires The hiring rate held steady at 4.4 percent. Construction employment grew by 75,000. Hires dcreased in information (-29,000). The number of hires barely moved throughout all four areas.

Separations

Total separations include quits, layoffs, and discharges, as well as other types of separations. Quits are generally self-initiated separations. Thus, the quits rate may be used to gauge employees’ inclination or capacity to leave their positions. Layoffs and discharges are involuntary separations initiated by the employer. Other separations may occur as a result of retirement, death, incapacity, or transfers to other locations within the same business.

In February, the overall number of separations and the rate of separations remained stable at 6.1 million and 4.1 percent, respectively. Total separations dropped (-45,000) in information and finance and insurance (-41,000). The overall number of separations barely changed throughout all four areas.

The number and rate quits were changed little in February at 4.4 million and 2.9 percent, respectively. Quits increased in r etail commerce (+74,000); durable goods manufacturing (+22,000); and state and local government education (+14,000). In finance and insurance, quits declined (-30,000). The number of quits remained changed little throughout all four areas.

The number of layoffs and discharges barely moved at 1.4 million in February. The rate remained constant at 0.9 percent. In information, layoffs and discharges fell (-60,000). In all four areas, the number of layoffs and discharges had little movement.

Other separations were stable at 355,000 in February. Other separations grew (+20,000) in retail commerce and (+9,000) in information. The degree of other separations dropped in finance and insurance (-19,900); transportation, warehousing, and utilities (-16,600); and real estate and rental and leasing (-6,000). Other separations had small movement throughout all four areas.

Net Change in Employment

Each month, a large number of hires and separations occur. The link between hiring and separations determines the net employment change. Employment increases when the number of hires exceeds the number of separations, employment rises, even if the quantity of hires remains constant or declines. In contrast, employment drops when the number of hires is smaller than the number of separations, employment declines, even if the quantity of hiring remains constant or increases.

Hires totalled 77.0 million and separations totaled 70.6 million in the 12 months ending in February 2022, resulting in a net employment increase of 6.4 million. These totals include workers who may have been hired and terminated separated multiple times throughout the year.

Disclaimer:

Analyst Certification -The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer(s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view(s) expressed by that research analyst in this research report.

Company Disclosure -The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.