August 11, 2023

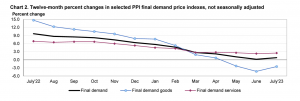

In July, the seasonally adjusted Producer Price Index (PPI) for final demand increased by 0.3 percent, as reported by the U.S. Bureau of Labor Statistics. This follows unchanged final demand prices in June and a 0.3 percent decline in May. Over the unadjusted 12-month period ending in July, the index for final demand showed growth of 0.8 percent. The rise in July’s final demand prices was driven by a 0.5 percent increase in the index for final demand services and a 0.1 percent uptick in prices for final demand goods. Notably, the index for final demand, excluding food, energy, and trade services, saw a significant 0.2 percent increase in July—the largest since February’s 0.3 percent rise. Over the 12 months ending in July, prices for final demand excluding these components saw a substantial advance of 2.7 percent.

Final demand services

In July, the index for final demand services experienced a notable increase of 0.5 percent, marking the largest rise since August 2022 when it also increased by 0.5 percent. The upward movement was driven by a widespread growth in prices for various final demand services. Specifically, prices for final demand services, excluding trade, transportation, and warehousing, went up by 0.3 percent. Final demand trade services recorded a 0.7 percent increase in margins, while the index for final demand transportation and warehousing services rose by 0.5 percent. These measurements of trade indexes track changes in margins received by wholesalers and retailers.

Final demand goods

In July, prices for final demand goods showed a slight increase of 0.1 percent, following no change in June. This rise was primarily driven by a 0.5 percent increase in the index for final demand foods. However, prices for final demand goods, excluding foods and energy, remained unchanged, as did prices for final demand energy.

Disclaimer:

Analyst Certification – The views expressed in this research report accurately reflect the personal views of Mayberry Investments Limited Research Department about those issuer(s) or securities as at the date of this report. Each research analyst (s) also certify that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendation(s) or view(s) expressed by that research analyst in this research report.

Company Disclosure – The information contained herein has been obtained from sources believed to be reliable, however its accuracy and completeness cannot be guaranteed. You are hereby notified that any disclosure, copying, distribution or taking any action in reliance on the contents of this information is strictly prohibited and may be unlawful. Mayberry may effect transactions or have positions in securities mentioned herein. In addition, employees of Mayberry may have positions and effect transactions in the securities mentioned herein.